Market Observations & Portfolio Commentary

Mid Cap – 2023 vs. RMC

Full Year Market Update

For the year, the broader market posted solid gains, with the Russell 3000 up 26.0%. At the start of 2023, interest rates were rising, inflation was stubbornly high, and investors were bracing for a recession. Instead, inflation continued falling, consumers kept spending, and the unemployment rate fell to its lowest level since 1969. With slowing inflation, signs of better balance in the labor market, and normalized GDP growth expectations, the Federal Reserve indicated that it would pivot to rate cuts later in 2024. Huge rallies by the mega-cap Magnificent 7 (Apple, Microsoft, Amazon, NVIDIA, Alphabet, Tesla, & Meta Platforms) were a big driver of overall index performance, and narrow market leadership remained a nagging concern for much of the year.

It was a year of bifurcated performance, led by the mega-cap stocks. Enthusiasm over artificial intelligence and robust gains by the Magnificent 7 led to significant outperformance of the Growth Indices and helped mask weakness in other corners of the market. Non-dividend paying companies significantly outperformed companies that pay a regular dividend, especially in the large cap space. Turning to market factors for the year, Volatility and Growth factors posted the strongest results. Value, Yield, and Momentum factors presented headwinds; while Quality and Momentum factors delivered mixed results.

Key Performance Takeaways for the Year

-

The London Company Mid Cap portfolio gained 28.6% (28.2% net) for the year vs. a 17.2% gain in the Russell Midcap Index. Both sector allocation and stock selection were tailwinds to performance.

-

The Mid Cap portfolio outperformed its benchmark and exceeded our 85-90% upside participation expectations. We typically would not expect such strong relative results in a robust, double-digit return environment, but several factors worked in our favor. Quality attributes, including high net interest coverage and returns on capital, shone prominently, particularly as many unprofitable companies in the lower market cap spectrum struggled. Our largest positions performed well, opportunistic trades and recent initiations paid off, and we navigated the year with few major setbacks. A sector-level leadership reversal also played a role, with our limited exposure to Energy and Utilities transforming from a drag in 2022 to a tailwind in 2023.

Top 3 Contributors to Relative Performance

-

Lennox International (LII) – LII outperformed, benefitting from both upward revisions to estimates and multiple expansion. LII has exceeded near term earnings expectations and management has behaved rationally with respect to capital allocation, selling the unprofitable and subscale international businesses, and announcing a bolt-on acquisition in a logical adjacency at what appears to be an attractive multiple. We continue to have a high degree of confidence in the quality of the business and the ability of management to execute, but acknowledge the stock is likely closer to our estimate of intrinsic value after the strong run. We reduced the position on strength.

-

Entegris (ENTG) – ENTG’s outperformance reflects its ability to grow faster than the industry and the improved stability in the semiconductor market. Demand remains solid for ENTG‘s mission critical products needed for the transition to advanced semiconductor nodes. These leading edge nodes are largely on schedule and require more materials to achieve higher yields. ENTG is one of the most diversified players in the semi-materials industry with its size and scale. We remain attracted to the industry’s high barriers to entry, limited competitors, and high switching costs.

-

Copart (CPRT) – CPRT shares were strong in 2023 reflecting the company’s ability to gain share and increase auction volume at higher prices. In addition, margins could move higher as total loss frequencies normalize. CPRT is benefiting from structural shifts in the industry such as the increase in vehicle complexity, higher repair costs, and stronger auction involvement from both domestic and international buyers. The company has leading market share in all of its markets and continues to widen its moat with capacity expansions. The fundamentals and trends remain strong for the business.

Top 3 Detractors from Relative Performance

-

Hasbro (HAS) – HAS shares underperformed in 2023 reflecting weakness in its Consumer business from a lackluster holiday season in the prior year that left lingering inventory issues and uncertainty about category growth. Separately, Wizards of the Coast continues to excel from both the Dungeon & Dragons and Magic: The Gathering franchises. Hasbro has been taking costs out of the business by eliminating roughly one-third of its headcount this year. The company completed the sale of eOne in December 2023 and will use the proceeds to de-lever the balance sheet, which should help protect the dividend. We believe reduced corporate complexity and improving fundamentals are both near-term catalysts for the stock.

-

Post Holdings (POST) – Shares of POST underperformed during the year reflecting weaker investor sentiment toward the manufactured food industry. The industry benefitted from price-driven growth the last couple of years, with prices now expected to moderate or even deflate going forward. Within Post, Foodservice profits have normalized back to pre-avian flu levels and will be a headwind to growth next year.

-

Unifirst (UNF) – UNF management reduced guidance twice earlier in the year reflecting sustained cost pressures. Margins remain meaningfully compressed relative to pre-pandemic levels. On the positive side, pricing remains strong, as customers seem to understand the justification of higher cost of service. We believe the company should be able to normalize margins over time, due to the oligopolistic nature of the industry, especially now that ARMK has spun out their Uniform Services segment.

Sector Influence

We are bottom-up stock pickers, but sector exposures influenced relative performance as follows:

-

What Helped: Overweight Industrials (a better performing sector) & underweight Utilities (a weaker performing sector)

-

What Hurt: Overweight Cons. Staples & Materials (two weaker performing sectors)

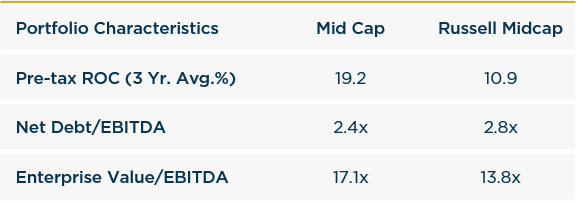

Portfolio Characteristics & Positioning

We believe the Mid Cap portfolio is positioned for long-term durability and possesses the fundamental ingredients that stand the test of time: wide moats, sustainably high returns on capital, strong cash flow generation, low leverage ratios, and trading at a reasonable valuation. As access to capital becomes more difficult and the cost of that capital is more expensive, we believe companies with strong balance sheets and the ability to self-fund their operations could have a structural advantage in 2024 and beyond. In an environment of possibly lower returns and greater volatility, we believe the Mid Cap portfolio offers an attractive option for equity investors.

Source: FactSet

Looking Ahead

After such a strong 2023, we believe investors should temper expectations for 2024. Stocks defied rate hikes, wars, collapsed banks, and recession fears in 2023. Now, calls for a soft landing are consensus; sentiment is overly optimistic; and markets are priced for very little risk. Predicting the future direction of the economy is always challenging. While we do agree the odds of a recession have come down, they are still elevated. A soft landing remains in reach, but much of that hinges on whether the Fed eases soon enough to avoid an employment problem. Perhaps this time it will be different, but historically the odds of sticking the landing have been very low. Even though we have greater clarity over the Fed’s path from here, there still remains a long list of items creating uncertainty that could lead to greater volatility in 2024.

In terms of the equity market, we believe returns in the near term may be modest, with shareholder yield (dividends, share repurchase, debt reduction) comprising a significant percentage of the total return. Economic growth is likely to slow; earnings estimates appear optimistic; and valuations are somewhat elevated. Moreover, investors continue to expect a faster pace of rate cuts than members of the FOMC currently suggest. The difference in the pace of rate reductions could lead to greater levels of volatility in 2024. Markets are impossible to outguess in the short run, but we believe the antidote to uncertainty is quality and that solid company fundamentals will lead to strong risk-adjusted returns in the long run. With that in mind, the characteristics of our portfolios remain attractive, and we believe we’re well positioned for an uncertain future.

We believe the Mid Cap portfolio is positioned for long-term durability and possesses the fundamental ingredients that stand the test of time.

Annualized Performance

As of 12/31/2023

Inception date: 3/31/2012. Past performance should not be taken as a guarantee of future results. Performance is preliminary. Subject to change.