Market Observations & Portfolio Commentary

SMID Cap – 2023 vs. R2500V

Full Year Market Update

For the year, the broader market posted solid gains, with the Russell 3000 up 26.0%. At the start of 2023, interest rates were rising, inflation was stubbornly high, and investors were bracing for a recession. Instead, inflation continued falling, consumers kept spending, and the unemployment rate fell to its lowest level since 1969. With slowing inflation, signs of better balance in the labor market, and normalized GDP growth expectations, the Federal Reserve indicated that it would pivot to rate cuts later in 2024. Huge rallies by the mega-cap Magnificent 7 (Apple, Microsoft, Amazon, NVIDIA, Alphabet, Tesla, & Meta Platforms) were a big driver of overall index performance, and narrow market leadership remained a nagging concern for much of the year.

It was a year of bifurcated performance, led by the mega-cap stocks. Enthusiasm over artificial intelligence and robust gains by the Magnificent 7 led to significant outperformance of the Growth Indices and helped mask weakness in other corners of the market. Non-dividend paying companies significantly outperformed companies that pay a regular dividend, especially in the large cap space. Turning to market factors for the year, Volatility and Growth factors posted the strongest results. Value, Yield, and Momentum factors presented headwinds; while Quality and Momentum factors delivered mixed results.

Key Performance Takeaways for the Year

-

The London Company Small-Mid Cap portfolio gained 24.8% (23.9% net) for the year vs. a 16.0% increase in the Russell 2500 Value Index. Sector exposure and stock selection were both tailwinds.

-

Our SMID portfolio outperformed the Russell 2500 Value Index and exceeded our 85-90% upside participation expectations. We typically would not expect such strong relative results in a robust, double-digit return environment, but several factors worked in our favor. Quality attributes, including high net interest coverage and returns on capital, shone prominently, particularly as many unprofitable companies in the lower market cap spectrum struggled. Our largest positions performed well, opportunistic trades and recent initiations paid off, and we navigated the year with few major setbacks. A sector-level leadership reversal also played a role, with our limited exposure to Energy and Utilities transforming from a drag in 2022 to a tailwind in 2023.

Top 3 Contributors to Relative Performance

-

Deckers (DECK) – DECK thoughtfully manages top brands in the footwear industry, which has allowed them to outperform other retailers in the current environment. UGG and HOKA are benefitting from brand heat, and management stays focused on acquiring and retaining customers. DECK continues to diversify revenue through the growth of HOKA (non-seasonal), and the expansion of UGG into new categories.

-

Entegris (ENTG) – ENTG outperformance reflects its ability to grow faster than the industry and the improved stability in the semiconductor market. Demand remains solid for Entegris’ mission critical products needed for the transition to advanced semiconductor nodes. These leading edge nodes are largely on schedule and require more materials to achieve higher yields. ENTG is one of the most diversified players in the semi-materials industry with its size and scale. We remain attracted to the industry’s high barriers to entry, limited competitors, and high switching costs.

-

Trex (TREX) – TREX continued its rally through 4Q on optimism for future rate cuts as a potential help to demand for composite decking and all things construction. The company performed very well in 2023 primarily due to an improving macro outlook. TREX entered the decking slowdown from a position of strength, and we have been pleased but not surprised by the company’s execution. We continue to have a high degree of confidence in the competitive positioning of TREX as a market leader in an oligopoly, and the ability of management to execute well operationally, allocate capital rationally, and maintain a strong balance sheet.

Top 3 Detractors from Relative Performance

-

Lancaster Colony (LANC) – Fundamentals at LANC remain strong, but investor sentiment toward the manufactured food industry has weakened in recent months. These companies benefitted from price-driven growth the last couple of years, with prices now expected to moderate or even deflate going forward. With ERP and capacity expansions complete, and mix continuing to shift towards margin-accretive volumes, LANC should realize tailwinds to margins and free cash flow over the next 12 months. LANC has attractive opportunities for growth, and the cash balance sheet is available to support investment.

-

Hanover Insurance (THG) – Shares of THG underperformed in 2023 reflecting increased scrutiny of commercial real estate. THG has relatively high exposure to CRE through their ownership of collateralized mortgage backed securities, which is likely partly accountable for the underperformance this quarter. Additionally, THG results were impacted by an unlucky streak of catastrophic weather in their core regions, areas that typically have far less catastrophe losses than CA, TX, FL, LA, etc. where THG has deliberately avoided catastrophe exposure. Investment portfolio aside, we continue to have confidence in the company’s discipline and strategy in navigating this challenging underwriting environment.

-

Jack Henry (JKHY) – JKHY shares underperformed the broader market this year due to negative banking headlines early in the year and lower free cash flow conversion. JKHY continues to gain share in core accounts and complementary products as financial institutions are using technology to drive revenue growth. Margins are expected to expand this year due to higher topline growth and cost efficiencies. We remain confident in management’s ability to execute and believe the business model is very attractive with recurring revenue, long-term contracts, and high switching costs.

Sector Influence

We are bottom-up stock pickers, but sector exposures influenced relative performance as follows:

-

What Helped: Underweight both Health Care & Utilities (two weaker performing sectors)

-

What Hurt: Overweight Cons. Staples (a weaker performing sector) & underweight Information Technology (a better performing sector)

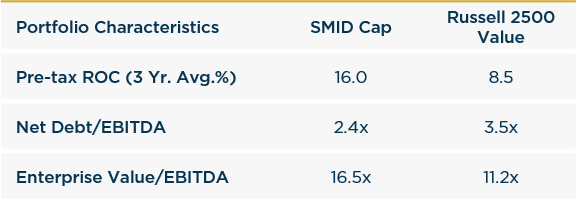

Portfolio Characteristics & Positioning

We believe the SMID portfolio is positioned for long-term durability and possesses the fundamental ingredients that stand the test of time: wide moats, sustainably high returns on capital, strong free cash flow generation, low leverage ratios, and an attractive shareholder yield (dividends + net buybacks). The portfolio trades at a premium to the Value index, but we believe this is justified as companies in the Value indices have lower returns on capital and higher leverage. As access to capital becomes more difficult and the cost of that capital is more expensive, we believe companies with strong balance sheets and the ability to self-fund their operations could have a structural advantage in 2024 and beyond. In an environment of possibly lower returns and greater volatility, we believe the SMID portfolio offers an attractive option for equity investors.

Source: FactSet

Looking Ahead

After such a strong 2023, we believe investors should temper expectations for 2024. Stocks defied rate hikes, wars, collapsed banks, and recession fears in 2023. Now, calls for a soft landing are consensus; sentiment is overly optimistic; and markets are priced for very little risk. Predicting the future direction of the economy is always challenging. While we do agree the odds of a recession have come down, they are still elevated. A soft landing remains in reach, but much of that hinges on whether the Fed eases soon enough to avoid an employment problem. Perhaps this time it will be different, but historically the odds of sticking the landing have been very low. Even though we have greater clarity over the Fed’s path from here, there still remains a long list of items creating uncertainty that could lead to greater volatility in 2024.

In terms of the equity market, we believe returns in the near term may be modest, with shareholder yield (dividends, share repurchase, debt reduction) comprising a significant percentage of the total return. Economic growth is likely to slow; earnings estimates appear optimistic; and valuations are somewhat elevated. Moreover, investors continue to expect a faster pace of rate cuts than members of the FOMC currently suggest. The difference in the pace of rate reductions could lead to greater levels of volatility in 2024. Markets are impossible to outguess in the short run, but we believe the antidote to uncertainty is quality and that solid company fundamentals will lead to strong risk-adjusted returns in the long run. With that in mind, the characteristics of our portfolios remain attractive, and we believe we’re well positioned for an uncertain future.

We believe the SMID Cap portfolio is positioned for long-term durability and possesses the fundamental ingredients that stand the test of time.

Annualized Performance

As of 12/31/2023

Inception date: 3/31/2009. Past performance should not be taken as a guarantee of future results. Performance is preliminary. Subject to change.

The SMID Cap product is typically compared to the Russell 2500 Index. Any comparison to the Russell 2500 Value is for illustrative purposes only.