To clients and friends of The London Company

Broadening Back to New Highs (and Lofty Valuations)

Executive Summary

- Q2 saw markets rebound back toward their starting point for the year, despite early volatility from U.S. tariffs and escalating trade tensions. A tariff pause drove a strong recovery, pushing year-to-date returns positive.

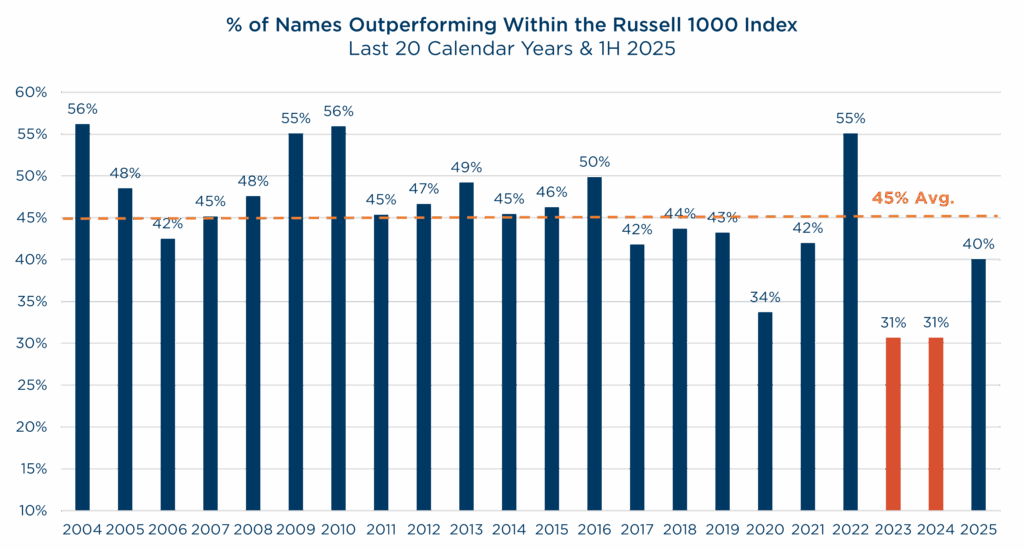

- Market broadening continued, with 40% of Russell 1000 stocks outperforming the index. That said, expensive, high beta companies led the risk-on rally, diverging from our quality-focused approach.

- The London Company’s portfolios had mixed results. Large Cap and Income Equity lagged the core benchmarks, but Income Equity outperformed the Russell 1000 Value Index. Our Mid Cap, SMID, and Small Cap portfolios trailed their benchmarks and our upside capture expectations. International delivered another quarter of strong absolute returns, with relative results in line with our 85-90% upside capture expectations.

- Markets remain concentrated and expensive, with macro risks like economic slowdown, tariffs, geopolitics, and inflation threatening further volatility. A surge in insider selling suggests caution despite retail optimism.

Markets climbed the proverbial wall of worry in Q2 and ended near their starting point for the year. Volatility surged early in the quarter due to new U.S. tariffs aimed at reshaping global trade, escalating tensions with China and driving market uncertainty to levels unseen since the 2008 financial crisis or early 2020 pandemic. However, a 90-day tariff pause announced on April 9th triggered a strong market recovery that continued through the quarter, despite heightened Middle East tensions late in the period. A double-digit, risk-on rally pulled year-to-date returns into positive territory for the broader market.

Despite these swirling macro winds, the market broadening that began in the first quarter persisted through the first half of 2025. Within the Russell 1000, 40% of the names outperformed the overall index. While this level remains modestly below the 20-year average of 45%, it represents a sharp improvement from the historically narrow markets of 2023 and 2024 which were dominated by outperformance from the Magnificent 7 companies.

Source: FactSet. Data from 12/31/2003-6/30/2025.

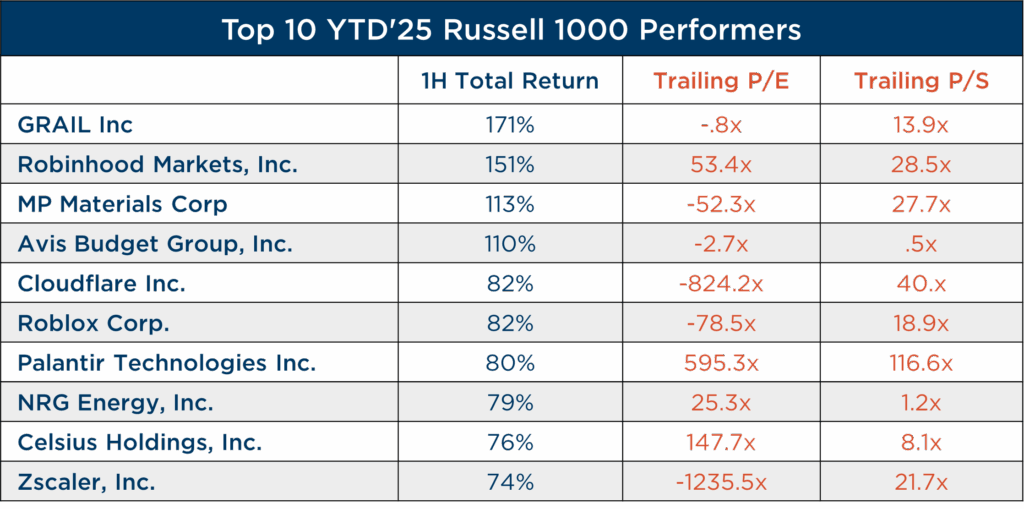

Looking underneath the hood of this market broadening, however, highlights evidence of exuberant growth expectations. Many of the top performing stocks possessed nosebleed level valuations, including elevated Price/Sales ratios and Price/Earnings ratios over 40x or negative (meaning they’re losing money)! As such, this market broadening, which typically favors active management over market-cap weighted indices, generally did not align with our focus on quality, lower volatility, and yield in the second quarter.

Source: FactSet. Data from 12/31/2024-6/30/2025.

Strategy Recap

The London Company portfolios delivered mixed results in Q2, but were largely out of favor in the robust return environment, led by beta and momentum factors. Our high-quality focus, while historically effective over time, faced challenges this quarter.

Our Large Cap and Income Equity portfolios failed to keep pace during the sharp broad market recovery in Q2 that generally favored higher beta and valuation factors over quality and yield. In fact, 70% of the S&P 500’s Q2 return came from stocks with a beta in the top quintile for the index. While our Income Equity strategy didn’t keep pace with the S&P 500, it did outperform the Russell 1000 Value Index. In addition, with the S&P 500 ending the quarter at an all-time high, we’ve been encouraged that our focus on downside protection has resulted in meaningful outperformance for the Income Equity strategy on both a YTD and Trailing 1-YR basis vs both the S&P 500 and Russell 1000 Value indices.

Our Mid Cap, SMID, and Small Cap portfolios fell short of our 85-90% upside capture expectations in Q2. Despite holding up well during their benchmarks’ biggest drawdowns earlier in the year, these strategies gave back all of their relative gains in Q2. Our exposure to Lower Volatility and Quality factors flipped from a tailwind to a headwind, as high beta and momentum factors rallied sharply following tariff de-escalation. Having no exposure to Utilities, the best performing sector, and pockets of idiosyncratic weakness were additional relative performance obstacles. As a reminder, fortunes can change quickly with a high conviction portfolio, and we remain confident in the durability of our companies’ fundamentals.

Our International Equity portfolio posted another quarter of strong absolute returns, and relative results fell right in line with our 85-90% upside capture expectations. While we slightly trailed the MSCI EAFA index’s robust, 20% first half return, we’re pleased with our comparative results that exceeded upside participation expectations.

Looking Ahead

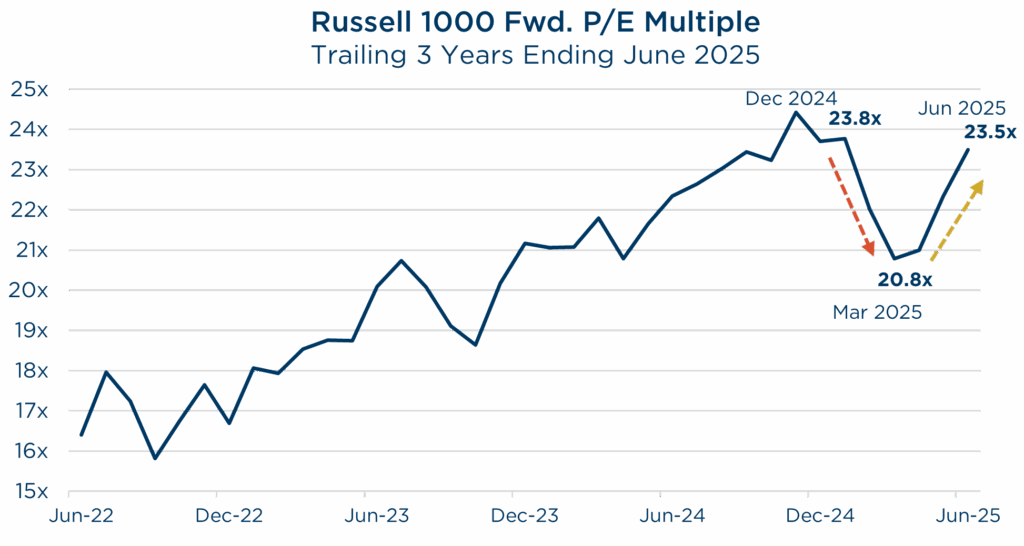

The sharp reversal in the second quarter once again highlighted the resiliency of U.S. equity markets, with many large cap indices hitting all-time highs. In addition, the temporary reprieve in valuations, driven by the Q1 sell-off, was also extremely short-lived. The Russell 1000’s forward P/E returned to ~23x, largely the same level that it started the year. As we head into the warmer months of summer, the recent 180 on valuations brings to mind a great summer rock classic, “Back Where It All Begins,” by The Allman Brothers Band.

Source: FactSet. Data from 6/30/2022-6/30/2025.

So where do we go from here? At the 2025 midpoint, markets remain concentrated and expensive, potentially limiting room for multiple expansion and raising the prospect of muted returns with higher volatility. Macro risks loom, including a slowing economy, ongoing tariff uncertainty, geopolitical tensions, and unclear inflation trends. While retail investor sentiment reflects FOMO (Fear of Missing Out), corporate insiders and institutional investors signal caution, with increased insider selling suggesting concerns over valuations, tariff uncertainty, and momentum sustainability.

The Allman Brothers song reference isn’t just a relevant point-to-point metaphorical reference, “Back Where It All Begins” is a song that encourages listeners to appreciate their origins and stay grounded in their roots. Having navigated a wide array of market environments over the last 3-plus decades we know that wealth accumulation rarely follows a linear path. We remain rooted to our long-term, fundamental investment approach, focusing on company quality, sustainable returns on capital, and resilience across economic scenarios.

As always, we appreciate and highly value the trust you have placed in us.

Markets remain concentrated and expensive, potentially limiting room for multiple expansion and raising the prospect of muted returns with higher volatility.

View Our Strategies

For more information