To clients and friends of The London Company

Speculation Thrives on Fertilizer, Quality Endures with Strong Roots

Executive Summary

- U.S. equities extended their rally in Q3, fueled by a Fed rate cut, strong GDP revisions, and enthusiasm around AI. Valuations, particularly in large-cap tech, now stand well above historical averages.

- The London Company portfolios faced headwinds in Q3 as quality factors underperformed and more speculative, high beta stocks rallied. Our Mid, SMID, and Small Cap portfolios trailed most, while Income Equity outperformed its value benchmark. International marked a strong two-year track record.

- Much like a garden requiring pruning, our focus remains on downside protection and compounding through durable, high-quality businesses rather than chasing speculative growth.

- With stretched valuations, rising capital intensity in tech, and echoes of past bubbles, we see strong roots—durable advantages, clean balance sheets, and reasonable valuations—as the path to lasting returns.

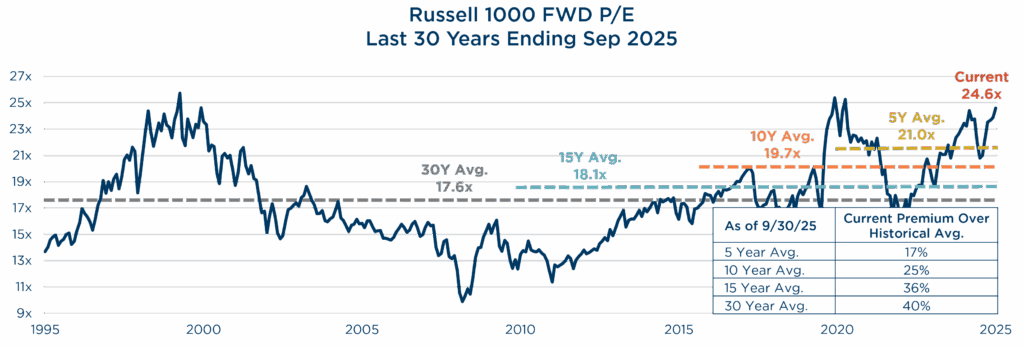

As fall arrives, many of us turn to our yards—pruning back summer’s overgrowth, aerating soil, and planting seeds that will strengthen our lawns come spring. Markets, too, have seasons. This summer was marked by rapid growth and exuberance, particularly in high-beta and large-cap technology stocks. U.S. indices ended the period at or near record highs, with valuations—especially in mega-cap tech—standing 25% above their 10-year averages.

Source: FactSet. Data from 9/30/1995-9/30/2025.

Equities advanced in the third quarter, extending the rally that began after President Trump’s April tariff reprieve. Momentum accelerated in September when a softening labor market justified a 25-basis-point Federal Reserve rate cut, while revisions to GDP and productivity highlighted an economy still running at a solid 3.8 percent growth rate. The Fed now faces the delicate challenge of supporting labor markets while guarding against inflation in a potentially re-accelerating economy.

Valuations expanded across most sectors, although technology remains the most stretched. Investor enthusiasm for artificial intelligence has lifted multiples beyond the earnings growth that many companies have delivered. Technology’s share of the Russell 1000 recently reached a record 33 percent, surpassing the level observed during the dot-com era. In our view, diversification through active management with a focus on downside protection is more important than ever. Much like a garden that grows too quickly, the market is showing signs of overgrowth and requires thoughtful pruning.

Strategy Recap

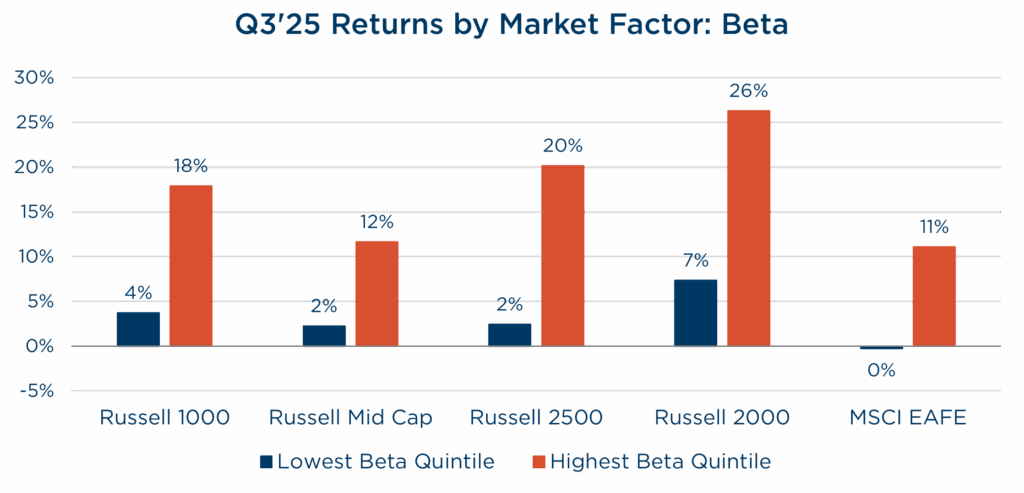

Similar to Q2, The London Company portfolios faced headwinds in Q3 as quality factors underperformed and more speculative, high beta stocks continued to rally throughout the quarter. This trend transcended all equity markets but was most pronounced down the market cap spectrum.

Source: FactSet. Beta – 52-week vs NYSE. Data from 6/30/2025-9/30/2025.

This dynamic was reflected across the relative performance of our portfolios. Versus the Core benchmarks, each of our portfolios fell short of our long-term upside capture target of 85-90%. Our Mid, SMID & Small Cap portfolios trailed by the widest margins. Our Income Equity portfolio was the lone bright spot. While it trailed the S&P 500 in Q3, it outperformed its primary benchmark, the Russell 1000 Value, and the strategy remains ahead of both benchmarks year to date, courtesy of strong downside protection earlier in the year. In other positive news, our International strategy celebrated its two-year anniversary. Its roots system is off to a great start, with performance since inception firmly ahead of its benchmark and very attractive risk characteristics.

While these recent relevant results are frustrating, it’s important to note that they’re consistent with historical patterns. In the aftermath of recessions or policy shifts, markets often reward speed and speculation over stability. The past six months—shaped by tax reform, Fed easing, lower long-term rates, tariff clarity, and record capital spending—acted like fertilizer, giving new life to risk-taking. Quality factors usually lag in these circumstances, then regain leadership when fundamentals reassert themselves.

Our philosophy has always been to accept these periods with patience. Just as a gardener knows that pruning today produces healthier blooms later, we believe protecting capital during speculative surges is the surest way to compound wealth across full cycles.

The past six months—shaped by tax reform, Fed easing, lower long-term rates, tariff clarity, and record capital spending—acted like fertilizer, giving new life to risk-taking. Quality factors usually lag in these circumstances, then regain leadership when fundamentals reassert themselves.

Looking Ahead

Many commentators argue today’s higher valuations are the “new normal,” justified by AI’s potential, higher structural margins, or a changed market composition. While tempting, history cautions against assuming “this time is different.”

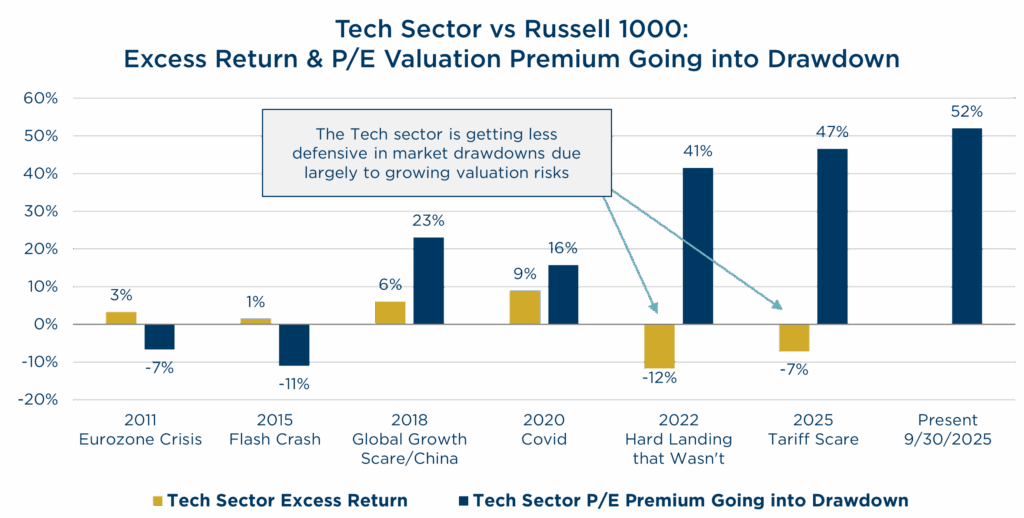

First, technology’s role as a defensive ballast has weakened. In past drawdowns, such as 2020’s Covid decline, technology provided defensive support. More recently, however, lofty valuations have stripped away that margin of safety. During the 2022 and 2025 corrections, tech underperformed. When the market’s most crowded trade loses its resilience, the risk of contagion grows.

Source: FactSet. Data from 4/30/2011-9/30/2025. *Please see important disclosures for full details.

Second, the AI spending boom risks transforming a historically capital-light sector into an increasingly capital-intensive one. Parallels to the 1990s fiber buildout and Tech Bubble abound. Circular financing arrangements—where chipmakers (think NVIDIA) fund their customers (think OpenAI), who then spend back on chips—echo the vendor-financing playbook of the 1990s. Back then, enthusiasm overshot demand, leaving overcapacity and sharp corrections. Today, Sam Altman, the CEO of OpenAI, recently remarked, he thinks the AI market may already be in a bubble. If the man at the center of the revolution is flashing yellow lights, investors would be wise to take notice.

To be clear, we are not dismissing AI’s transformative potential. Our portfolios hold select companies exposed to AI, energy, and data-center growth. However, we prefer firms with diversified revenue streams, healthy free cash flow, and valuations we consider reasonable. In our experience, focusing on companies with such quality characteristics offers steadier growth across seasons.

This fall, as we prepare our yards for the months ahead, we are reminded of our own discipline in investing. Markets may continue their upward march, but with valuations stretched and speculative weeds abundant, we believe success depends on cultivating businesses with strong roots: durable competitive advantages, clean balance sheets, and reasonable valuations. Our role is not to chase every sprout of momentum but to manage portfolios with care. Just as a well-tended yard weathers frost and thrives in spring, we believe our Quality-at-a-Reasonable-Price philosophy will help clients enjoy lasting beauty and resilience in their portfolios.

As always, we appreciate and highly value the trust you have placed in us.

View Our Strategies

For more information