Insights from the CIO

Founder, Chairman, and Chief Investment Officer

Investment Takeaways

-

Berkshire’s story offers a powerful reminder: being a quality, long-term investor is easier said than done.

-

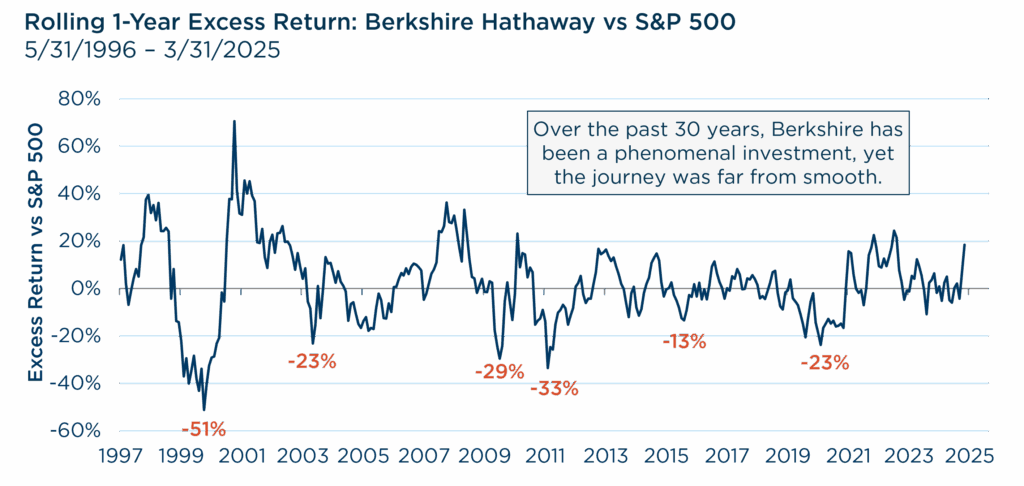

Over the past 30 years, Berkshire outperformed the S&P 500 but lagged in 45% of rolling one-year periods, including a notable -50% lag during the 1998-2000 Tech Bubble period.

-

Buffett’s success underscores the importance of focusing on high-quality businesses with durable competitive advantages, purchased at reasonable prices, and held through market volatility and short-term noise.

-

The key takeaway for investors is to embrace emotional resilience and independent thinking, enduring short-term setbacks to achieve long-term gains, as Buffett exemplified.

Perspectives on the Market

With Warren Buffett’s announcement that he will be stepping back from Berkshire Hathaway, it feels fitting to reflect not only on his extraordinary legacy, but also on the timeless lessons his career offers investors.

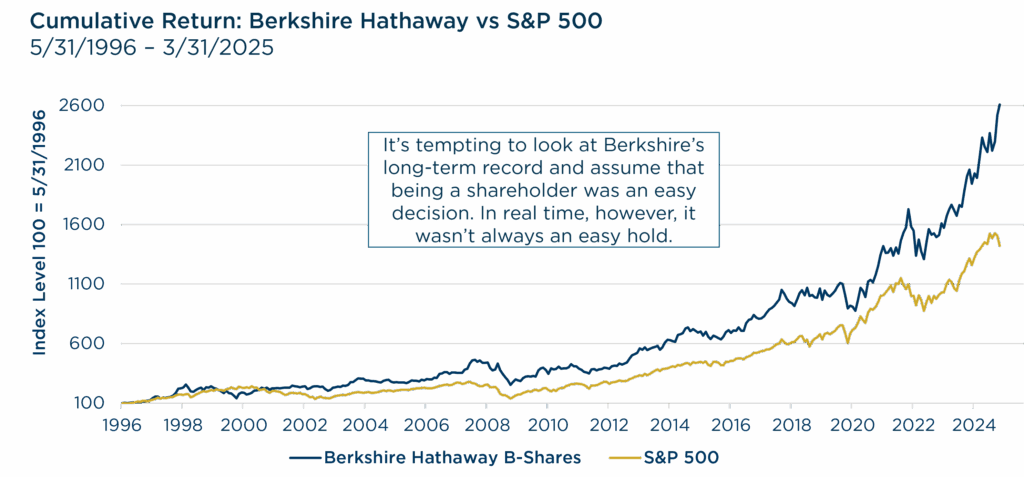

It’s tempting to look at Berkshire’s long-term record—decades of outperforming the S&P 500—and assume that being a Berkshire shareholder was an easy decision. In hindsight, it looks obvious. In real time, however, it was anything but easy. Berkshire’s story offers a powerful reminder: being a quality, long-term investor is easier said than done.

Source: Zephyr. Data from 5/31/1996 – 3/31/2025. Past performance should not be taken as a guarantee of future performance.

The Berkshire Hathaway Experience

Over the past 30 years, Berkshire has been a phenomenal investment, compounding wealth at a rate that has trounced the broader market. Yet the journey was far from smooth.

Despite its tremendous long-term success, the stock lagged the S&P 500 in roughly 45% of rolling one-year periods over the past three decades. Even over three-year periods, it only outperformed about half the time. Along the way, the stock regularly underperformed the broader market by 20%, 30%, and even 50% — most notably during the tech bubble, when it lagged more than -50% between 1998 and 2000. For much of that time, the crowd was busy declaring Buffett “washed up,” arguing that the old rules of valuation no longer applied.

For anyone living through those periods, it didn’t feel like an easy hold. It felt like a mistake. It’s one thing to study the clean, upward-sloping line of a thirty-year stock chart. It’s another thing entirely to live through the years where that line moved sharply downward — often while flashier investments seemed to soar. Staying patient required extraordinary discipline, emotional resilience, and a willingness to look foolish in the short run.

Source: Zephyr. Data from 5/31/1996 – 3/31/2025. Past performance should not be taken as a guarantee of future performance.

That, more than anything, was Warren Buffett’s true gift. It wasn’t merely the ability to find great businesses; it was the ability to hold them through thick and thin, to stick with principle over popularity. He knew that chasing market trends and popular delusions was a reliable way to destroy wealth, not create it.

Lessons for Today

These lessons feel especially relevant today. April 2025, for example, was one of the wildest “flat” months in recent memory. It was full of volatility and noise but ended not far from where it began.

It’s a perfect illustration of why macro-driven investing is so perilous. Markets are noisy, headlines are loud, and narratives shift with astonishing speed. In this kind of environment, it’s easy to get whipsawed by headlines, to overreact to short-term moves, or to obsess over the recent underperformers in a portfolio.

That is why Berkshire’s record is such a powerful case study. Instead of constantly adjusting to the latest macro scare, Buffett adhered to a steady, less glamorous approach: find high-quality businesses with durable competitive advantages, pay reasonable prices, and stay patient through the inevitable ups and downs. It’s a strategy that demands the ability to endure discomfort and avoid overacting to short-term noise. While the ride was rocky and there were long, uncomfortable stretches of underperformance, the results were extraordinary for those long-term investors who stayed patient and trusted the underlying quality of the business.

In Summary

As we honor Warren Buffett’s remarkable career, it’s worth remembering that his greatest investments weren’t just in businesses—they were in timeless principles: patience, discipline, and independent thinking. Warren Buffett often said, “the stock market is a device for transferring money from the impatient to the patient.” Long-term investing sounds easy. In reality, it demands the emotional fortitude to endure short-term pain for long-term gain. Buffett showed the way. The challenge and the opportunity for all of us is to follow his example, even when the going gets tough.

Warren Buffett often said, “the stock market is a device for transferring money from the impatient to the patient.”

View Our Strategies

See the latest performance data