Market Observations & Portfolio Commentary

Small Cap – 2024 vs. R2000

Full Year Market Update

U.S. equities posted another strong year of performance in 2024, in almost a carbon copy of 2023’s robust gains. An easing of macro risks (lower inflation and a weakening labor market), a shift at the Federal Reserve to less restrictive monetary policy, and a late-year election bump drove market gains. And like last year, there was a wide dichotomy in leadership as the market favored larger cap growth over smaller cap value. While equity markets delivered strong headline gains in 2024, these returns were largely driven by multiple expansion, leaving valuations elevated and the market increasingly reliant on a handful of mega-cap leaders. Looking at market factors, Growth, Volatility, Size, and Momentum factors had the most positive impact on relative returns, while Value, Yield, and most of the Quality factors presented headwinds.

Key Performance Takeaways for the Year

-

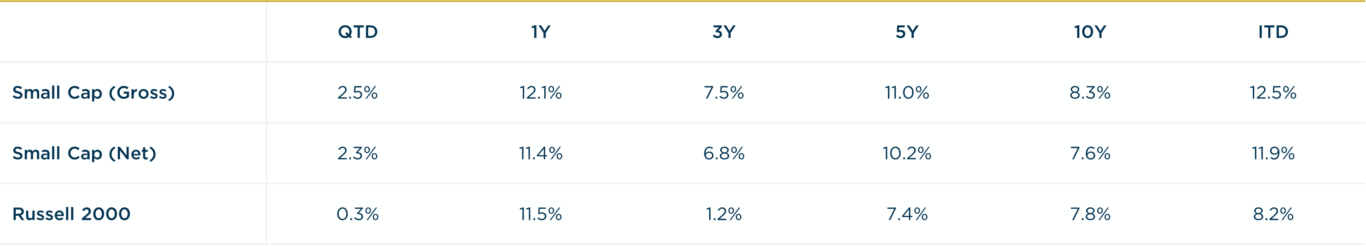

The London Company Small Cap portfolio returned 12.1% (11.4% net) year-to-date vs. a 11.5% increase in the Russell 2000 Index. Sector exposure had a positive impact on relative performance, partially offset by stock selection.

-

The Small Cap portfolio exceeded our 85-90% upside participation expectations in 2024. A recovery in 4Q resulted in annual results outperforming the benchmark. Our exposure to companies that generate strong returns on equity was a tailwind to relative performance.

-

Looking ahead, the opportunity down the market cap spectrum is meaningful. Valuations are at historically attractive levels for smaller companies compared to large caps. That said, there is a need to stay up in quality given the elevated rate backdrop, the corporate debt wall maturity approaching, and sluggish demand environment. We believe our Small Cap portfolio is well positioned to capitalize on attractive relative valuations while avoiding the pitfalls associated with lower-Quality, smaller cap companies.

Top 3 Contributors to Relative Performance

-

Masonite International Corp. (DOOR) – Shares of DOOR were up over 55% early in the year after receiving a buyout offer from Owens Corning for $133 per share.

-

Revolve Group, Inc (RVLV) – RVLV doubled in 2024 due to a reversal in business fundamentals that previously weighed on results in 2022 and 2023. RVLV returned to positive and robust sales growth during the year. Margins are benefitting from a recovery in demand and structural changes to make operations more profitable. The company is staying abreast of industry developments and thoughtfully pursuing reinvestment opportunities with an eye to the long term. Our conversations with management throughout the year confirm this thesis.

-

ACI Worldwide, Inc. (ACIW) – We added 1% to our ACIW stake in April and the stock subsequently outperformed during the year. ACIW continues to report fundamentally better results that leave us increasingly convicted in management’s ability to achieve a sustainably higher rate of organic growth. Historically ACIW has not taken full advantage of their favorable positioning as a critical partner to banking customers. Under the new CEO’s direction, ACIW is pursuing and successfully winning expanded revenue opportunities with its long-standing customers.

Top 3 Detractors from Relative Performance

-

Certara, Inc. (CERT) – CERT was added to the Small Cap portfolio in early 2024 and was our largest underperformer. While we still have conviction in our long-term thesis on CERT, we admit to having been overly optimistic about the recovery in CERT’s end markets. In 2024, the biotech funding environment remained soft and large biopharma was generally still working through widespread cost-cutting measures. CERT’s software business was resilient through this cycle, but the services business was weaker than we expected. As of the latest update, the services business is seeing a reacceleration. The management team is also exploring a strategic review of the least resilient portion of the services business, which we view as non-core to both the company’s long-term strategy and our long-term thesis.

-

Qualys, Inc. (QLYS) – QLYS underperformed in 2024 reflecting a challenging macro environment for cybersecurity spending. QLYS was pricing in relatively high expectations at the beginning of the year after a strong rally in 2023 (up 75%). Our conviction in the stock reflects its strong product strategy, competitive moat, and potential to improve its go-to-market execution, all of which are intact despite the macro issues.

-

Landstar System, Inc. (LSTR) – LSTR faced challenges throughout the year due to a continued soft spot freight environment, driven by lingering weakness in the U.S. manufacturing sector. Loose truck capacity also contributed to lower volumes and revenue. Despite challenges, LSTR maintained a strong balance sheet and continued to return capital to shareholders through dividends and share repurchases. We remain attracted to LSTR reflecting its variable cost business model, which we believe can limit downside in the shares.

Sector Influence

We are bottom-up stock pickers, but sector exposures influenced relative performance as follows:

-

What Helped: Underweight Health Care and Energy (weaker performing sectors)

-

What Hurt: Overweight in both Consumer Discretionary and Communication Services (weaker performing sectors)

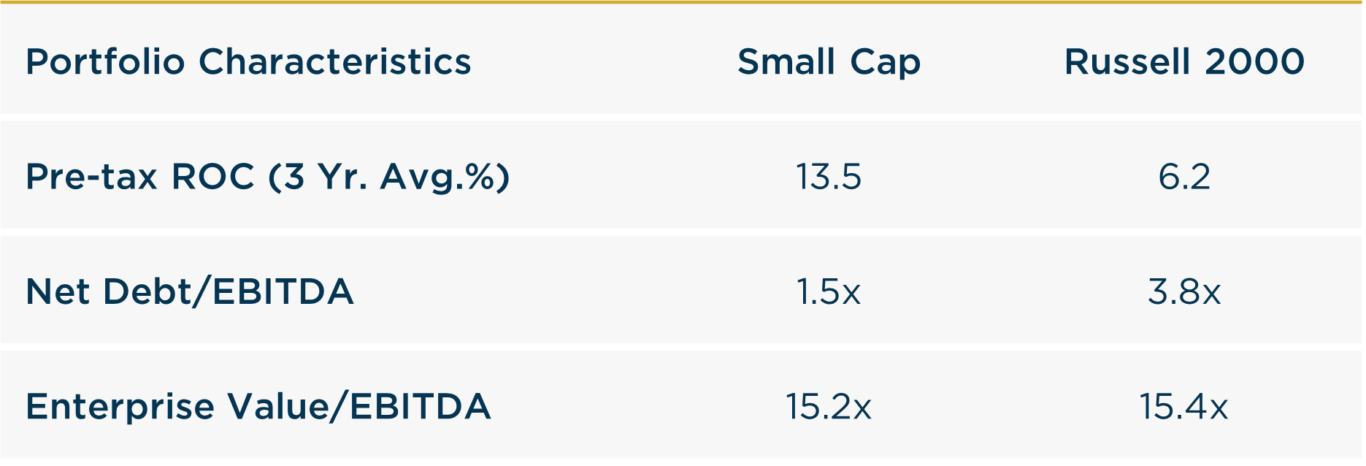

Portfolio Characteristics & Positioning

We believe the Small Cap portfolio is positioned for long-term durability and possesses the fundamental ingredients that stand the test of time: wide moats, sustainably high returns on capital, strong cash flow generation, low leverage ratios, and trading at a reasonable valuation. As a corporate debt maturity wall approaches and the cost of that capital stays elevated, we believe companies with strong balance sheets and the ability to self-fund their operations could have a structural advantage in 2025 and beyond. In an environment of possibly lower returns and greater volatility, we believe the Small Cap portfolio offers an attractive option for equity investors.

Source: FactSet

Looking Ahead

As we enter 2025, we believe the market faces an inflection point where sustaining momentum becomes increasingly difficult. Across the real economy, demand still seems sluggish and clear late-cycle signals persist. Revenue growth and corporate profits have leaned on inflationary pricing, but margins face growing headwinds as inflationary pricing fades, input costs rise, and demand softens. The Fed cut rates during 2024, but the yields on longer-dated treasuries actually rose as the year ended. Stubbornly high borrowing costs continue to plague rate-sensitive areas of the economy, like housing. Employment and inflation data may be volatile in 2025 and could affect changes in monetary policy and lead to greater volatility across equity markets.

Despite resilient economic data and limited signs of credit risk, we believe vigilance is warranted. Our cautious posture persists due to high valuations, market concentration, looming debt challenges, and fraying consumer health. We anticipate lower expected returns in the near term, based on slowing growth (function of restrictive monetary policy) and high valuations. Valuation multiple expansion can only take the market so far (particularly late in a market cycle). We expect a reversion to the mean whereby earnings growth & dividends drive returns going forward. While optimism remains high, the vulnerabilities of momentum-driven leadership highlight the need for discipline. Markets may reward risk-taking in the short term, but lasting wealth is built through patience, real income, and fundamentals.

We believe the Small Cap portfolio is positioned for long-term durability and possesses the fundamental ingredients that stand the test of time.

Annualized Returns

As of 12/31/2024

Inception date: 9/30/1999. Past performance is no guarantee of future results. Performance is preliminary. Subject to change.