Insights from the CIO

Founder, Chairman, and Chief Investment Officer

Investment Takeaways

-

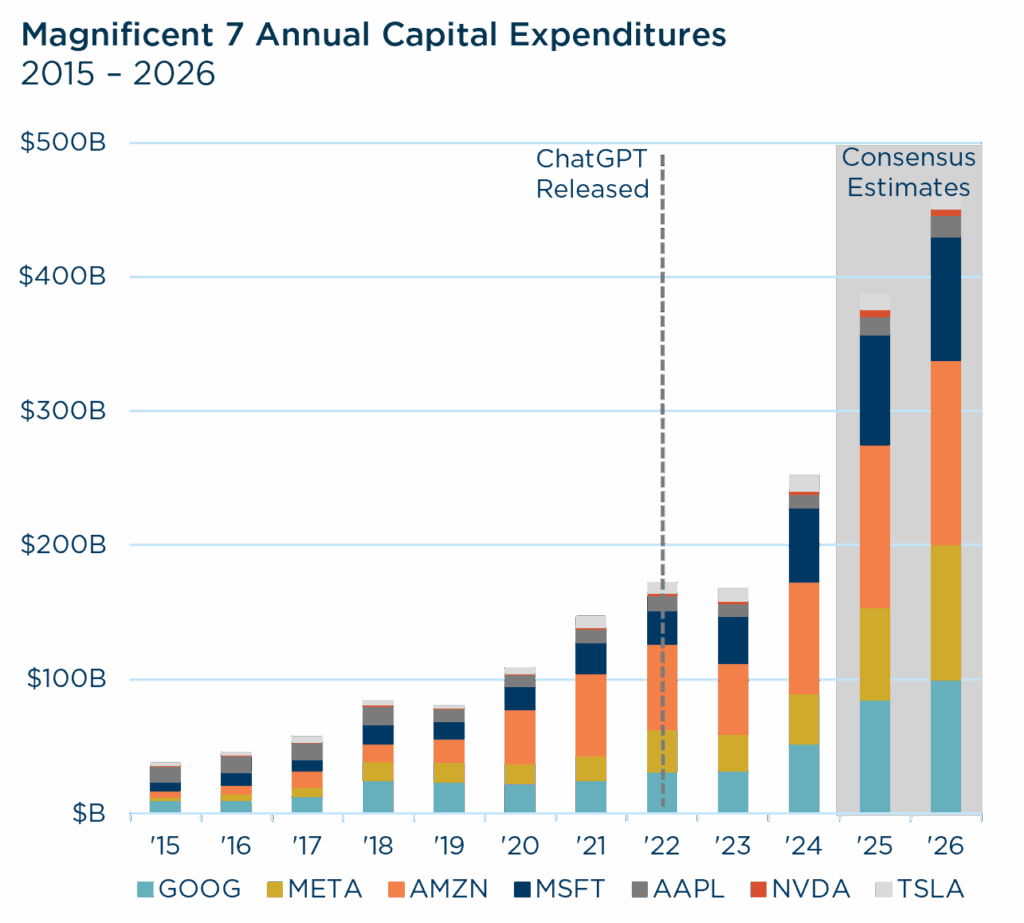

Artificial intelligence is driving an unprecedented wave of capital spending by the Magnificent 7 companies & Big Tech, with forecasts suggesting annual capex could exceed $460 billion in 2026.

-

Capital Cycle Theory reminds us that high returns attract investment, which attracts competition, often leading to overcapacity and weaker returns.

-

Even insiders like Sam Altman have warned that the AI market may already be in bubble territory, underscoring the risks of assuming current spending will automatically translate into durable profits.

-

As Quality-at-a-Reasonable-Price investors, we believe the right approach is to remain selective, focus on resilient businesses, and prioritize downside protection over chasing momentum.

Perspectives on the Market

Yogi Berra famously quipped, “It’s déjà vu all over again,” and that sentiment feels apt today as we watch another powerful wave of capital expenditure reshape markets. Driven by the promise of artificial intelligence and digital infrastructure, the largest technology companies are investing heavily in data centers, semiconductors, and cloud platforms. While the scale of these investments is striking, they also revive a timeless investing lesson: capital flows where returns appear brightest—until they don’t.

While the technology feels unprecedented, the investment story is not. Capital Cycle Theory has a simple lesson: strong profits invite competition, competition breeds capacity, and capacity eventually dilutes the very profits that started the cycle. As valuation-aware investors focused on downside protection, we believe it’s critical to ask whether the current AI-led capex boom will create lasting value or just the illusion of it.

The Capital Cycle in Context

We have seen this movie before. In the 1860s-1870s, railroads expanded across America at a breakneck pace until track mileage outpaced demand. In the 1990s, telecom firms laid fiber optic cables fast enough to wrap around the globe, only to discover the internet was not yet ready to fill them. In the 2010s, shale drillers conquered the oil market but left shareholders with years of disappointing returns. The U.S. housing boom of the 2000s followed a similar arc: easy credit, overbuilding, and ultimately a painful bust that reverberated through the global economy.

In each case, the underlying technologies and drivers were real and consequential; however for investors, valuation and discipline mattered far more than the prevailing narrative.

Today’s Capex Boom

Capital expenditures in U.S. equity markets have surged, but the growth is far from uniform. Financials and “old economy” sectors have been subdued. By contrast, the Magnificent 7 technology and communication giants are driving the bulk of today’s increase. AI sits at the center of it: hyperscale data centers, custom chips, and cloud buildouts.

Source: Strategas & Goldman Sachs. Data as of 8/22/2025. Past performance should not be taken as a guarantee of future performance.

The acceleration after the release of ChatGPT is striking, and the sheer scale of projected investment is a reminder that this cycle is still in full swing. So far, the math looks defensible. Revenues have largely kept pace with spending. Operating margins have not cracked. Capex as a share of sales has not exploded. In capital cycle terms, we are still in the gold rush phase. Everyone is digging, and for now, the nuggets are plentiful.

A Familiar Pattern, with a Modern Twist

The risk, however, is that capital keeps pouring in faster than profitable opportunities can absorb it. That is when valuations and returns can come under pressure. As Sam Altman, the CEO of OpenAI, recently remarked, he thinks the AI market may already be in a bubble. If the man at the center of the revolution is flashing yellow lights, investors would be wise to take notice.

This does not mean the spending spree ends tomorrow. Big Tech has the balance sheets and investor support to keep fueling capex. However, cycles are cycles. When everyone is confident that spending will “inevitably” deliver outsized profits, that is precisely when caution is warranted.

Investment Implications: Discipline vs. Momentum

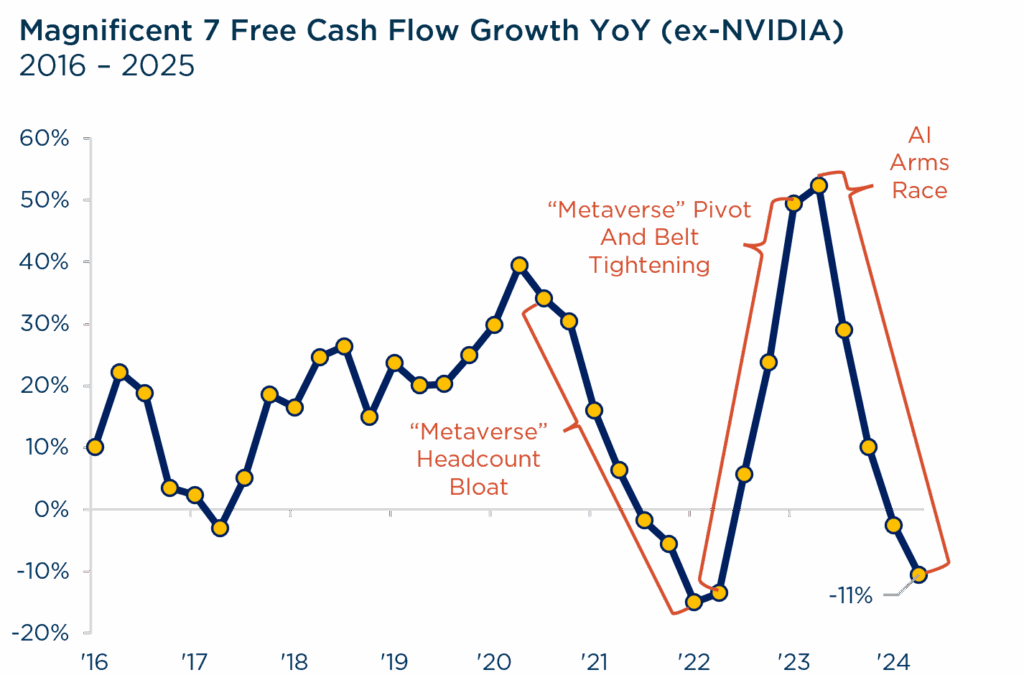

We are not AI skeptics, but we are capital cycle realists. Great technologies do not always make great investments, especially when capital is abundant. The assumption embedded in today’s elevated valuations is that these investments will deliver sustainably high returns on capital. That’s a big bet, especially when the free cash flow growth of these historically “capital light” companies has turned negative.

Valuations in the heaviest-spending sectors have already stretched to levels that require near-flawless execution. If the returns on these vast AI investments fall short or simply take longer than markets expect, the next phase could be multiple compression. Investors chasing the momentum of today’s winners may discover tomorrow’s laggards.

Source: Strategas. Data from 12/31/2016 – 3/31/2025. Past performance should not be taken as a guarantee of future performance.

Our focus remains on businesses with durable competitive advantages, strong balance sheets, and management teams that have proven themselves careful stewards of capital. In past booms and busts, these were the companies that endured and often thrived once capital grew scarce again. As Howard Marks likes to remind us, “There are old investors, and there are bold investors, but there are very few old, bold investors.”

In Summary

AI will almost certainly reshape the economy, however that does not guarantee investors an easy payday. Capital cycles remind us that when too much money chases the same opportunity, the odds of disappointment rise no matter how exciting the technology.

The Magnificent 7 have the scale and balance sheets to keep spending, and their projects may well deliver breakthroughs. History, however, tells us that periods of heavy investment are often followed by periods of thinner returns.

We do not claim to know when or how this cycle will turn, only that it will. Our priority is the same as always: owning quality businesses at reasonable prices, with the resilience to withstand changing tides. In investing, protecting the downside is often the surest path to compounding on the upside.

As Sam Altman, the CEO of OpenAI, recently remarked, he thinks the AI market may already be in a bubble. If the man at the center of the revolution is flashing yellow lights, investors would be wise to take notice.

View Our Strategies

See the latest performance data