Market Observations & Portfolio Commentary

Income Equity – 1Q2025 vs Russell 1000 Value

Market Update

U.S. equities entered correction territory in 1Q25 after notching two robust years of strong gains. Macro risks returned to the forefront of investors’ minds as tariff and austerity uncertainties compounded stubbornly weak economic growth and a return of the inflation specter. Broader market weakness was driven by negative earnings revisions, declining consumer and business confidence, and no change in monetary policy from the Federal Reserve. For the quarter, the broader market, as measured by the Russell 3000 Index, declined 4.7%. A faltering Artificial Intelligence growth narrative allowed for a broadening of market leadership. Value styles led Growth, and Large Caps outperformed Small Caps. Turning to market factors, Value and Yield factors posted the strongest returns. Most of the Quality factors outperformed as well. Growth, Volatility (high beta), and Momentum factors had a negative impact.

Key Performance Takeaways

-

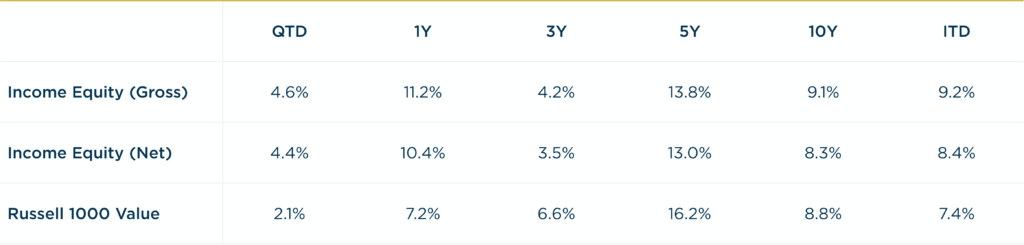

The London Company Income Equity portfolio returned 4.6% (4.4% net) during the quarter vs. a 2.1% increase in the Russell 1000 Value Index. Relative outperformance was driven by stock selection, partially offset by sector exposure headwinds.

-

The Income Equity portfolio outperformed the Russell 1000 Value in Q1, and exceeded our expectations of 85-90% upside capture. Our exposure to Yield, Lower Volatility & Quality factors shined as high beta and momentum driven equities sharply corrected. Income Equity faced significant sector headwinds during the period, so we were encouraged to see the portfolio overcome these obstacles and play strong defense amidst the volatility.

Top 3 Contributors to Relative Performance

-

Philip Morris International Inc. (PM) – PM shares outperformed due to strong execution and an improving outlook. The primary driver remains the success of its smoke-free products, with sustained momentum in IQOS and ZYN, supported by robust pricing in the combustibles portfolio. We believe the combination of smoke-free growth potential and a resilient combustibles business will generate significant and sustainable free cash flow in the years ahead.

-

Progressive Corporation (PGR) – PGR outperformed during the quarter, driven by improved margins, faster growth than the industry, and a rise in policies in force. PGR’s superior underwriting risk segmentation continues to translate to industry-leading accident frequency outcomes. We remain confident in PGR’s ability to execute in all environments, competitive advantages, and capital allocation strategies.

-

Nintendo Co., Ltd ADR (NTDOY) – NTDOY was a top performer driven by excitement surrounding the Switch 2 launch, with management expressing optimism about early demand signals and increasing production capacity accordingly. This positive momentum aligns with our long-term thesis, reinforcing our confidence in the company’s potential for a highly successful and profitable console cycle.

Top 3 Detractors from Relative Performance

-

Apple Inc. (AAPL) – AAPL underperformed after reporting lower iPhone sales, particularly in China, and its tariff exposure. Its large installed base and services are an important long term driver of the business. We remain attracted to its strong balance sheet, R&D spending, and capital allocation philosophy.

-

Microsoft Corporation (MSFT) – MSFT was a negative performer after reporting a more cautious growth outlook for Cloud and margin pressure from ongoing AI investments. We continue to like MSFT’s competitive advantages, leadership in generative AI, diversified revenue streams across cloud and enterprise software, and capital allocation strategy.

-

BlackRock, Inc. (BLK) – BLK underperformed despite reporting solid 4Q results, including strong flows and organic fee growth. Underperformance in 1Q has more to do with market sensitivity of the asset management business than changes in the long-term fundamentals of BLK’s operations. We continue to like BLK for its advantaged competitive positioning, low leverage, and consistent capital return.

Sector Influence

We are bottom-up stock pickers, but sector exposures influenced relative performance as follows:

-

What Helped: Overweight position in both Consumer Staples and Communication Services (better performing sectors)

-

What Hurt: Overweight in Information Technology (a weaker performing sector) and underweight in Health Care (a better performing sector)

Trades During the Quarter

-

Initiated: Corning Inc (GLW) – Company manufactures specialty glass, ceramics, and optical products for a wide range of industries including telecommunications, consumer electronics, automotive, and life sciences. GLW’s innovation-driven model spans Display, Optical Communications, Specialty Materials, and Environmental Technologies, providing multiple revenue streams. GLW benefits from AI-driven demand, as its fiber optic cables are essential for high-speed data transmission in AI data centers. More AI computing power requires more fiber connectivity. GLW’s high fixed costs mean revenue growth should drive margin expansion with limited incremental costs. Robust R&D spend and centralized innovation create a cost advantage, strengthening GLW’s moat. ROIC improved to 12.5% in FY24. Management has a solid track record of capital allocation. The company boasts a 2%+ dividend yield, has increased buybacks over the past decade, and maintains a healthy balance sheet. We have owned GLW shares in the past and maintain a positive view due to their history of innovation and ability to generate diversified revenue streams. We believe the company is positioned for strong revenue growth stemming from secular and cyclical trends in Display and Optical Communications.

-

Sold: Merck & Co., Inc. (MRK) – Sale reflects concerns surrounding the impending Keytruda patent cliff and the potential for dilutive acquisitions. The patent cliff concern has intensified following challenges faced by Gardasil in China and uncertainties surrounding the company’s vaccine business in the current regulatory environment.

Looking Ahead

There is elevated uncertainty as we start the second quarter with a high likelihood of greater tariffs being announced in the weeks ahead. Consumer confidence has declined recently due to the risks of additional tariffs, but the broader economic data still supports growth in the near term, but growth is decelerating. While we are not predicting a recession, the odds of a recession have increased. In terms of monetary policy, the Fed appears to be on a steady course for two or three rate cuts later in the year. The effect of tariffs on both inflation and the broader economy could change those plans though.

Despite the recent correction, the market concentration and valuations remain elevated. History shows that transitions following peak market concentration (e.g. the Nifty Fifty or the Tech Bubble) tend to play out over multiple years—not quarters. The cap-weighted indices may continue to face pressure as investors reassess stretched valuations and excessive positioning. We believe that equity returns in the near term may be modest, with shareholder yield (dividends, share repurchase, debt reduction) comprising a significant percentage of the total return from equities. Defensive portfolios such as ours should be favored areas for investors if recession concerns remain or materialize. Importantly, Quality factors have historically posted their best relative returns during periods of decelerating growth and through recessions. Quality factors typically lag in the early days of a recovery and keep pace during the mid-cycle years. We may be late in the economic cycle now. If that is correct, it bodes well for the relative performance of Quality factors over the next few years and for our portfolios.

Annualized Returns

As of 3/31/2025

Inception date: 12/31/1999. Performance is preliminary. Subject to change. Past performance should not be taken as a guarantee of future results. Net of fee returns are calculated net of a model management fee of 0.75%. Please see the disclosure notes found on the bottom of the page.