Market Observations & Portfolio Commentary

Income Equity – 3Q2025 vs Russell 1000 Value

Market Update

U.S. equities continued their advance in Q3, fueled by a Fed rate cut, solid corporate earnings and enthusiasm around AI. Economic data released throughout the third quarter was mixed, but the economy retained most of its momentum from the second quarter. Expectations for additional interest rate cuts by the Federal Reserve also drove more optimism in the market. Volatile, high beta stocks extended their sharp rebound off April 8th lows, notching the strongest high beta rally since the bounce off the Global Financial Crisis trough in 2009. For the quarter, the broader market, as measured by the Russell 3000 Index, increased 8.2%, and the S&P 500 and small-cap Russell 2000 both hit all-time record highs. Stylistically, Growth outperformed Value, and Small Cap stocks led Large Caps. Turning to market factors, Volatility and Yield factors posted the strongest returns. Value and Growth factors were mixed. Quality factors, which our portfolios tilt towards, were mostly headwinds.

Key Performance Takeaways

-

The London Company Income Equity portfolio increased 6.0% gross (5.8% net) during the quarter vs. a 5.3% increase in the Russell 1000 Value. Relative outperformance was attributable to positive stock selection, partially offset by sector exposure headwinds.

-

The Income Equity portfolio outperformed the benchmark & exceeded our 85-90% upside capture expectations. Despite our Quality, Yield, & lower Volatility factor exposure being out of favor, the portfolio exceeded expectations due to strong stock selection, including exposure to Magnificent 7 companies. We remain confident in our holdings: durable advantages, strong balance sheets, and steady free cash flow underpin long-term value.

Top 3 Contributors to Relative Performance

-

Corning Inc. (GLW) – GLW continues to outperform expectations, led by strong demand in its Optical Communications segment, particularly its GenAI-related products. Increasing data speed and bandwidth requirements, both inside and outside data centers, are boosting demand. The uptick in topline has driven meaningful operating leverage. We believe GLW’s diversified portfolio of innovative, value-added products is well-positioned to capitalize on secular growth trends.

-

Apple Inc. (AAPL) – AAPL remains a consistently strong performer, providing stability within the technology sector even amidst the elevated volatility of other large-cap growth stocks. Its earnings report beat expectations, driven by ongoing growth in the high-margin Services business and strong iPhone sales. Further, excitement over pre-orders and early sales of the iPhone 17 line helped drive performance. We continue to own AAPL for its strong user ecosystem and incredible cash flow production that it allocates in a positive manner.

-

TE Connectivity Ltd. (TEL) – TEL was a top performer as it is benefiting from AI spending plus delivering stronger margins despite a mixed demand environment in other end markets. Its diversified portfolio, high-value products, and market leadership, combined with disciplined capital allocation through dividends and buybacks, position it for sustained growth and margin expansion.

Top 3 Detractors from Relative Performance

-

Nintendo Co., Ltd. ADR (NTDOY) – NTDOY was a bottom performer this quarter due to volatility at the beginning of the console cycle, with data points and estimates being updated. It remains a top contributor for the year. We remain attracted to NTDOY’s integrated hardware-software model, brand franchises, and the strength of its balance sheet.

-

Philip Morris International Inc. (PM) – After a strong start to the year, PM shares pulled back during the quarter. Its smoke-free offerings continue to grow. IQOS continues to convert smokers and ZYN’s momentum was further supported by capacity additions. Margins are higher on smoke-free products. The stable combustibles business and robust smoke-free growth will drive significant, sustainable free cash flow over the long term.

-

Fidelity National Information Services, Inc. (FIS) – FIS underperformed in the quarter mainly due to inconsistent execution and a weaker outlook that requires an acceleration later this year. The company’s strong market position and recurring revenue base hold true, but there is now additional execution risk. Given these factors and our sizeable financial exposure, we chose to sell the position to fund higher conviction ideas within the portfolio.

Sector Influence

We are bottom-up stock pickers, but sector exposures influenced relative performance as follows:

-

What Helped: Overweight Information Technology (a better performing sector) & underweight Real Estate (a weaker performing sector)

-

What Hurt: Underweight Communication Services (a better performing sector) & overweight Consumer Staples (a weaker performing sector)

Trades During the Quarter

-

Exited: Diageo plc (DEO) – Sold amid lower conviction following consumer strain, industry headwinds, and leadership changes. We may revisit if spirits demand and management execution improve.

-

Exited: Fidelity National Information Services (FIS) – Sold to fund higher-conviction ideas. Despite an attractive core business, recent portfolio shifts create execution risk, and financials remain a large portfolio weight.

-

Exited: Nestle S.A. Sponsored ADR (NSGRY) – Sold to fund higher-conviction ideas. While we continue to like NSGRY’s business, operational challenges and management transition reduced near-term conviction.

-

Initiated: Cummins Inc. (CMI) – The global leader in heavy- and medium-duty truck engines, CMI benefits from strong customer relationships and a large installed base driving high-margin, recurring aftermarket revenue. Diversification into Power Systems adds stability through the trucking downturn, while a strong balance sheet and disciplined capital allocation support investment and shareholder returns. Positioned for an eventual rebound in truck demand and global growth, CMI’s scale, emissions expertise, and service network provide durable advantages. With shares near mid-cycle earnings, the stock offers an attractive entry point into a resilient, market-leading franchise.

-

Initiated: UnitedHealth Group (UNH) – UNH is the largest and most diversified health insurer in the U.S., anchored by two complementary platforms: UnitedHealthcare, which provides benefits to individuals and employers, and Optum, which offers healthcare services, data, and technology solutions. This integrated model gives UNH unmatched scale and insight into healthcare costs, enabling both efficiency and improved outcomes. Its vast provider networks, local dominance, and data-driven capabilities form durable competitive advantages and high barriers to entry. Long-term growth is supported by powerful demographics, as the aging U.S. population drives steady Medicare Advantage enrollment—a core UNH strength. While near-term elevated medical costs have pressured margins and weighed on the stock, we view these headwinds as temporary. UNH is already repricing future plans to reflect higher costs, supporting a gradual return to historical margin levels. With a recurring revenue base, diversified earnings, and financial strength, UNH offers attractive downside protection. At today’s valuation, we see a compelling opportunity to own a structural growth leader with resilient cash flows.

Looking Ahead

Despite the twists and turns of uncertainty, the U.S. economy has displayed impressive resilience this year. Housing, the impact of recent tariffs, and the labor market continue to be areas of concern. That said, the past six months were filled with powerful catalysts—including tax reform, Fed easing, lower long-term rates, tariff clarity, and record capital spending—which gave new life to risk-taking and economic optimism. Still, sticky inflationary pressures combined with a weakening labor market have complicated the Fed’s dual mandate.

Turning to equities, the markets remain concentrated and expensive, potentially limiting room for multiple expansion and raising the prospect of muted returns with higher volatility. Expectations are being partly driven by productivity gains, broadening of earnings growth, and less restricted monetary policy. Yet, the momentum and sustainability of AI and the capex behind it have been questioned more frequently. High beta rallies, like the past 6 months, are rare, short-lived and historically mean-reverting. In the aftermath of recessions or policy shifts, markets often reward speed and speculation over stability. Quality factors usually lag in these circumstances, then regain leadership when fundamentals reassert themselves. With valuations stretched & speculation abundant, we believe focusing on resilient, attractively valued businesses remains the best path to compounding wealth across full cycles. Our Quality-at-a-Reasonable-Price discipline is designed to protect capital during frothy periods and deliver steadier results when the cycle turns.

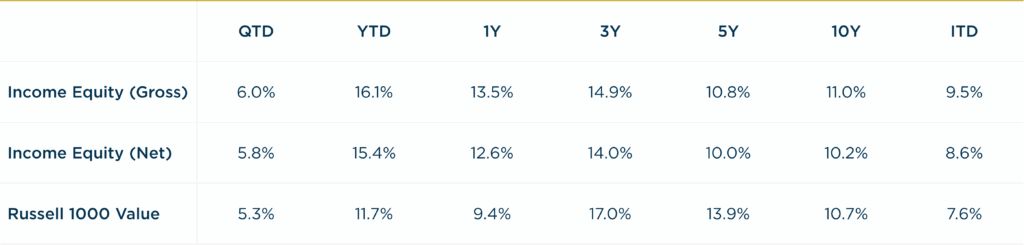

Annualized Returns

As of 9/30/2025

Inception date: 12/31/1999. Performance is preliminary. Subject to change. Past performance should not be taken as a guarantee of future results. Net of fee returns are calculated net of a model management fee of 0.75%. Please see the disclosure notes found on the bottom of the page.