Market Observations & Portfolio Commentary

International Equity – 3Q2025 vs MSCI EAFE

Market Update

Global equities extended their rally in 3Q, posting strong gains across developed and emerging markets. Economic growth across developed regions remained subdued but stable, and major central banks paused policy changes during the quarter. The MSCI All Country World Index rose 7.6% in 3Q, with U.S. stocks outperforming international peers as the S&P 500 advanced 8.1% versus a 4.8% gain for MSCI EAFE. Dollar strength modestly weighed on overseas returns. Year-to-date, international markets still lead, with MSCI EAFE up 25.1% compared to 14.8% for the S&P 500. Emerging markets added to robust gains, with MSCI EM rising 10.6% in 3Q and 27.5% YTD, driven by a 20.7% surge in China. Regional performance was led by Asia, where Japan’s market advanced 8.0% while Europe and the U.K. lagged at 3.6%.

Sector trends favored cyclical areas. Financials and Industrials drove roughly two-thirds of MSCI EAFE’s advance, led by Banks and Capital Goods, which together accounted for about 60% of total index gains. Banks continued to benefit from a benign credit backdrop and supportive interest-rate environment. Defensive groups such as Consumer Staples and Health Care underperformed. Turning to market factors, the Value, Yield, Size, Volatility, & Momentum factors were positive contributors during 3Q. Quality factors faced headwinds, while the Growth factor had mixed results.

Key Performance Takeaways

-

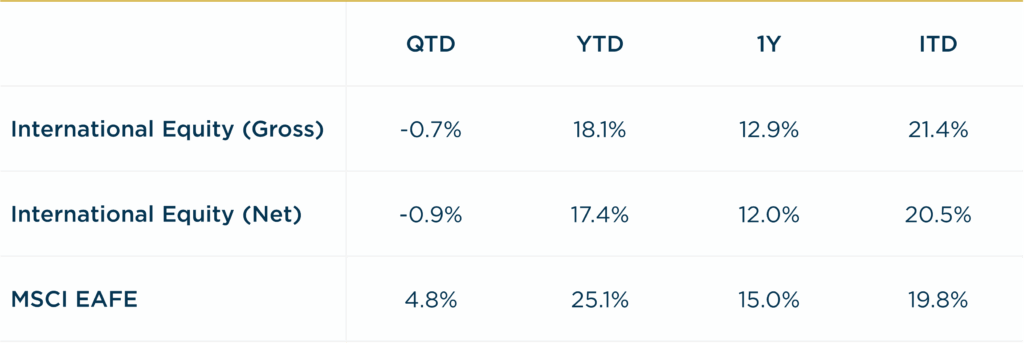

The International Equity portfolio declined 0.7% gross (0.9% net) during 3Q vs a return of 4.8% for the MSCI EAFE index. Sector exposure & stock selection were headwinds to relative performance.

-

Recent underperformance stemmed primarily from a sharp rebound in banks and deep-value sectors—areas where the International Equity portfolio has limited exposure. Pullbacks among several of our high-quality, structurally advantaged holdings were additional obstacles during the quarter. Our discipline is designed to protect capital during frothy periods & deliver steadier results when the cycle turns.

Top 3 Contributors to Relative Performance

-

CRH PLC (CRH) – CRH, a leading construction materials company, was the top contributor in the portfolio. The company raised guidance after reporting best-in-class volumes and continued margin expansion. CRH remains attractive as a competitively advantaged beneficiary of infrastructure investment and reindustrialization with consistently shareholder friendly capital allocation. Downside protection is underpinned by the company’s strong balance sheet, well-aligned management team, and defensive growth profile.

-

Taiwan Semiconductor Manufacturing Co., Ltd Sponsored ADR (TSM) – TSM, the leading semiconductor fabrication company, performed strongly in the quarter as sales performance exceeded expectations, confirming attractive demand fundamentals. The company’s dominant competitive position, favorable exposure to structural growth, and current valuation offers attractive upside.

-

ASML Holding NV (ASML NA) – ASML NA is a leading semiconductor equipment company with a dominant position in lithography. During the quarter, the company benefited from leading edge customers reiterating capex needs and medium-term growth expectations. Sentiment also improved due to inflecting memory demand trends and the US government’s investment in Intel. ASML NA remains attractively positioned to capitalize on its unrivaled competitive position supplying critical equipment to chip manufacturers in a structurally growing end markets.

Top 3 Detractors from Relative Performance

-

Nintendo Co Ltd (7974 JP) – Nintendo was a bottom performer this quarter due to volatility at the beginning of the console cycle, with data points and estimates being updated. It remains a top contributor for the year. We remain attracted to Nintendo’s integrated hardware-software model, brand franchises, and the strength of its balance sheet.

-

London Stock Exchange Group (LSEG LN) – LSEG LN underperformed in quarter as slower growth in recurring revenues, a disappointing report from a peer and general AI-risks weighed on market sentiment. As a leading provider of data, analytics and exchange services to financial market participants, LSEG LN is in a strong competitive position in a secularly growing market. With the pullback in the share, LSEG LN is attractively valued with a capable management team executing well and returning cash to shareholders.

-

SAP SE (SAP GY) – After a strong 2024, SAP GY underperformed as cloud enterprise software growth slowed in the current quarter. SAP GY, a leading enterprise software company, has invested heavily to transition its business from on-premise to the cloud which has depressed margins and obfuscated revenue growth trends. SAP GY is now leveraging those investments leading to higher revenue growth as the drag from licensing revenue declines abate and expanding margins as the company leverages fixed costs. We remain confident in the long-term potential.

Sector Influence

We are bottom-up stock pickers, but sector exposures influenced relative performance as follows:

-

What Helped: Underweight Utilities & Health Care (two weaker performing sectors)

-

What Hurt: Underweight Financials (a better performing sector) & overweight Consumer Staples (a weaker performing sector)

Trades During the Quarter

-

Exited: Seven & I Holdings Co (3382 JP) – 3382 JP, the corporate parent of the 7-11 convenience stores, successfully rejected its Canadian rival Couche-Tard’s take-out bid. While we view the valuation as modestly cheap, we don’t have high conviction in management’s reorganization strategy which includes listing a minority stake in its U.S. subsidiary. We sold and redeployed the capital where we have higher conviction with better risk/reward.

-

Increased: ICON PLC (ICLR), Unilever (ULVR LN), & Universal Music Group (UMG NA) – We added to our positions where we viewed attractive risk/reward opportunities.

Looking Ahead

From an economic perspective, we expect current trends in policy rates to remain accommodative across Europe and the UK. While domestic focused defense and infrastructure spending should provide modest boost to GDP providing boost to certain industries, we expect economic growth to remain subdued. Japan’s leadership change could create pressure to slow the normalization in policy rates higher and more stimulative fiscal policies. From a trade perspective, there’s a possibility of escalating trade tensions with China creating volatile market conditions.

In terms of equities, international markets added to robust YTD gains but the tailwind from the weaker USD moderated in the current quarter. International markets are still valued at a discount to the U.S, despite the YTD market moves. We believe this will continue to be supportive of fund flows into international markets. YTD the MSCI EAFE has been led higher by lower quality businesses – note that Bank industry group is up over 50% YTD and the quality factor has been a laggard. We believe this creates attractive opportunity for our process focusing on high quality companies with downside protection.

Annualized Returns

As of 9/30/2025

Inception date: 9/30/2023. Performance is preliminary. Subject to change. Past performance should not be taken as a guarantee of future results. Net of fee returns are calculated net of a model management fee of 0.75%. Please see the disclosure notes found on the bottom of the page.