Market Observations & Portfolio Commentary

Large Cap – 3Q2025 vs. Russell 1000

Market Update

U.S. equities continued their advance in Q3, fueled by a Fed rate cut, solid corporate earnings and enthusiasm around AI. Economic data released throughout the third quarter was mixed, but the economy retained most of its momentum from the second quarter. Expectations for additional interest rate cuts by the Federal Reserve also drove more optimism in the market. Volatile, high beta stocks extended their sharp rebound off April 8th lows, notching the strongest high beta rally since the bounce off the Global Financial Crisis trough in 2009. For the quarter, the broader market, as measured by the Russell 3000 Index, increased 8.2%, and the S&P 500 and small-cap Russell 2000 both hit all-time record highs. Stylistically, Growth outperformed Value, and Small Cap stocks led Large Caps. Turning to market factors, Volatility and Yield factors posted the strongest returns. Value and Growth factors were mixed. Quality factors, which our portfolios tilt towards, were mostly headwinds.

Key Performance Takeaways

-

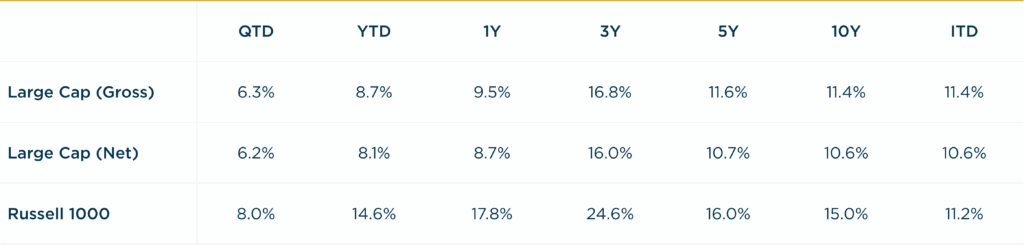

The London Company Large Cap portfolio increased 6.3% gross (6.2% net) during the quarter vs. a 8.0% increase in the Russell 1000. Stock selection was a headwind to relative performance, partially offset by positive sector exposure.

-

The Large Cap portfolio delivered strong absolute returns, but came up short of the Russell 1000 in Q3 and trailed our 85-90% upside capture expectations. Relative underperformance was entirely driven by sector exposure. Once again, leadership by volatility factors and the concentration of the index were material headwinds. We remain confident in our holdings: durable advantages, strong balance sheets, and steady free cash flow underpin long-term value.

Top 3 Contributors to Relative Performance

-

Alphabet Inc. (GOOG) – GOOG was a top performer following strong core business results and the accelerated adoption of its AI offerings. Favorable news on outstanding legal cases also helped. Management is effectively executing cost-saving initiatives while diversifying revenue through Cloud and subscriptions. We remain attracted to its massive ecosystem scale, sound capital allocation, and clean balance sheet.

-

TE Connectivity Ltd. (TEL) – TEL was a top performer as it is benefiting from AI spending plus delivering stronger margins despite a mixed demand environment in other end markets. Its diversified portfolio, high-value products, and market leadership, combined with disciplined capital allocation through dividends and buybacks, position it for sustained growth and margin expansion.

-

NewMarket Corporation (NEU) – NEU was a strong performer in the quarter, mainly due to three factors. First, low oil prices cut input costs faster than revenue, driving improved profitability. Second, a timely defense acquisition allowed NEU to ramp up production amid global conflicts. Finally, the market is positively viewing the company’s use of cash flow to repay debt.

Top 3 Detractors from Relative Performance

-

Fiserv, Inc. (FI) – FI underperformed this quarter due to slower growth and margin pressure in its Merchant business, leading to reduced guidance. Organic growth was weighed down by delayed product launches and cautious consumer spending. Despite Clover’s weaker volume growth, FI’s strong revenue from international expansion, new products, and its resilient Financial Solutions segment continues to remain healthy. We are attracted to its durable business model as it maintains a leadership position across its core segments and provides mission-critical services to its customers.

-

Progressive Corporation (PGR) – PGR was a bottom performer this quarter due to investor concerns over decelerating policy and premium growth, despite strong margins and strong retention driven by its leadership in personal auto insurance. We remain attracted to its best-in-class operations, conservative underwriting, and shareholder-friendly capital allocation philosophy.

-

Old Dominion Freight Line, Inc. (ODFL) – Trucking stocks in general, and ODFL specifically, have had challenging performance during the quarter due to the lingering softness in the industrial economy. ODFL continues to report declining volume trends as the “boom and bust” nature of post-COVID normalization is playing out. We believe that the industry is bumping along the bottom, and that even the slightest strengthening in trends will result in outperformance for the group and for ODFL. We like ODFL’s strong position in the industry, the superior returns that its business model generates, and management’s adeptness at capital allocation.

Sector Influence

We are bottom-up stock pickers, but sector exposures influenced relative performance as follows:

-

What Helped: Underweight Health Care & Real Estate (two weaker performing sectors)

-

What Hurt: Underweight Information Technology (a better performing sector) & overweight Financials (a weaker performing sector)

Trades During the Quarter

-

Exited: Bruker Corporation (BRKR) – We elected to sell our position in BRKR after shares significantly underperformed the broader market since our purchase in 2024. Headwinds from weak pharma spending, possible cuts to NIH and academic funding, and tariff concerns may continue. The stock hit our soft stop loss, and with no insider purchases or accelerated buybacks from the company, we elected to exit the position and fund a higher-conviction idea.

-

Initiated: Equitable Holdings, Inc. (EQH) – EQH a leading U.S. financial services company helping clients achieve retirement and wealth goals through three core businesses: Equitable (retirement and protection strategies), AllianceBernstein (global asset management), and Equitable Advisors (financial and wealth planning). Together, these franchises manage over $1 trillion in client assets. EQH operates with an asset-light model that generates strong free cash flow, which it uses to repurchase shares and grow dividends. Over the past five years, the share count has declined about 8% annually, while the dividend has compounded at a 7% growth rate, currently yielding 2.1%. A recent reinsurance transaction with Venerable released nearly $2 billion of excess capital to the holding company, reducing risk while validating reserves. As EQH continues shifting toward higher-quality, fee-based retirement and asset management businesses, we believe the market will reward it with a higher valuation multiple, reflecting its stronger growth profile, enhanced capital return, and lower risk structure.

Looking Ahead

Despite the twists and turns of uncertainty, the U.S. economy has displayed impressive resilience this year. Housing, the impact of recent tariffs, and the labor market continue to be areas of concern. That said, the past six months were filled with powerful catalysts—including tax reform, Fed easing, lower long-term rates, tariff clarity, and record capital spending—which gave new life to risk-taking and economic optimism. Still, sticky inflationary pressures combined with a weakening labor market have complicated the Fed’s dual mandate.

Turning to equities, the markets remain concentrated and expensive, potentially limiting room for multiple expansion and raising the prospect of muted returns with higher volatility. Expectations are being partly driven by productivity gains, broadening of earnings growth, and less restricted monetary policy. Yet, the momentum and sustainability of AI and the capex behind it have been questioned more frequently. High beta rallies, like the past 6 months, are rare, short-lived and historically mean-reverting. In the aftermath of recessions or policy shifts, markets often reward speed and speculation over stability. Quality factors usually lag in these circumstances, then regain leadership when fundamentals reassert themselves. With valuations stretched & speculation abundant, we believe focusing on resilient, attractively valued businesses remains the best path to compounding wealth across full cycles. Our Quality-at-a-Reasonable-Price discipline is designed to protect capital during frothy periods and deliver steadier results when the cycle turns.

Annualized Returns

As of 9/30/2025

Inception date: 6/30/1994. Performance is preliminary. Subject to change. Past performance should not be taken as a guarantee of future results. Net of fee returns are calculated net of a model management fee of 0.75%. Please see the disclosure notes found on the bottom of the page.