Market Observations & Portfolio Commentary

Mid Cap – 1Q2025 vs. Russell Midcap

Market Update

U.S. equities entered correction territory in 1Q25 after notching two robust years of strong gains. Macro risks returned to the forefront of investors’ minds as tariff and austerity uncertainties compounded stubbornly weak economic growth and a return of the inflation specter. Broader market weakness was driven by negative earnings revisions, declining consumer and business confidence, and no change in monetary policy from the Federal Reserve. For the quarter, the broader market, as measured by the Russell 3000 Index, declined 4.7%. A faltering Artificial Intelligence growth narrative allowed for a broadening of market leadership. Value styles led Growth, and Large Caps outperformed Small Caps. Turning to market factors, Value and Yield factors posted the strongest returns. Most of the Quality factors outperformed as well. Growth, Volatility (high beta), and Momentum factors had a negative impact.

Key Performance Takeaways

-

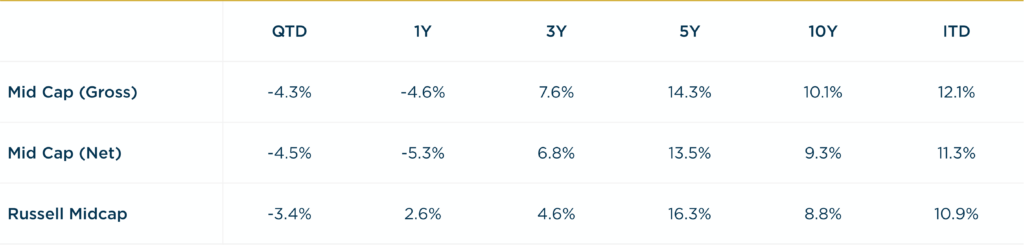

The London Company Mid Cap portfolio declined 4.3% (-4.5% net) during the quarter vs. a 3.4% decrease in the Russell Midcap Index. Sector exposure was a headwind to relative performance, partially offset by positive stock selection.

-

The Mid Cap portfolio trailed its benchmark in Q1, and came up short of our 75-80% downside capture expectations. The portfolio was plagued by sector headwinds, and our structural underexposure to high-momentum names, which had rallied sharply through year-end before pulling back in March, created a further headwind. A few idiosyncratic detractors emerged, but we do not see a unifying theme or breakdown. Rather, the quarter was a reflection of a market trying to sort out what matters most in a higher-volatility regime.

Top 3 Contributors to Relative Performance

-

Otis Worldwide Corportion (OTIS) – Despite tough 4Q24 earnings, OTIS shares rallied in the first quarter due to its low exposure to tariffs/global trade war risks. Our conviction in the stock reflects the company’s strong execution in the China market despite macro headwinds and the oligopolistic nature of the elevator and escalator industry.

-

Crown Castle International Corp (CCI) – CCI was a top performer this quarter after announcing the results for the fiber and small cell transaction. CCI will now be a U.S.-focused Tower company. The tower business is expected to grow ~5% over the long term and Tower margins have room for improvement. We like CCI’s stable revenue stream, long-term tailwinds on growth in data consumption, and its ability to return cash to shareholders through its dividend policy.

-

AerCap Holdings (AER) – AER shares performed well this quarter after reporting solid 4Q24 results. We believe the company is sitting in the enviable position of owning the largest portfolio of aircraft in a seller’s market. The company should be able to continue growing book value per share by selling off certain assets and buying back stock.

Top 3 Detractors from Relative Performance

-

Skyworks Solutions, Inc. (SWKS) – SWKS shares underperformed after it announced it would be losing sole control of an iPhone 17 component to a rival, cutting Apple revenue by ~13%, though Apple still drives ~70% of its sales. We still like SWKS for its tech strength, strong balance sheet, and capital allocation strategy.

-

Moelis & Co. Class A (MC) – MC shares were weak, reflecting uncertainty in the market, impacting the M&A environment. We continue to like MC’s debt-free balance sheet, strong shareholder focus, and willingness to reinvest in the business.

-

Bruker Corporation (BRKR) – BRKR shares lagged this quarter due to uncertainties over NIH funding and tariffs. The CEO stepped up and bought more shares amid the weakness. We remain optimistic about BRKR for its vital role in life sciences research, a global economic priority, supported by its robust competitive stance, innovative products, strategic capital allocation, and capable leadership.

Sector Influence

We are bottom-up stock pickers, but sector exposures influenced relative performance as follows:

-

What Helped: Underweight position in Information Technology (a weaker performing sector) and an overweight position in Consumer Staples (a better performing sector)

-

What Hurt: Underweight position in both Utilities and Energy (two better performing sectors)

Trades During the Quarter

-

Initiated: Ally Financial Inc (ALLY) – Largest digital-only bank in the U.S., best known for its strong position in auto lending. It focuses on prime borrowers, making its loan book higher quality than many competitors. With a new leadership team in place, ALLY is streamlining operations, cutting costs, and focusing on its most profitable areas. While current earnings are lower than normal, we believe the credit performance of ALLY’s auto loan book should improve reflecting higher net interest margin and cost controls. As conditions normalize, ALLY could resume stock buybacks and deliver meaningful earnings growth. We see this as a compelling opportunity to invest in a quality business at a discount, with clear catalysts that could drive solid returns over the next few years.

-

Increased: Entegris, Inc. (ENTG) – Added to position following weakness in the shares. ENTG as been a strong long-term compounder, and is a market leader in the production of consumables used in the chip manufacturing process. It has been weak recently due to a combination of investors taking some gains in the name and a slowdown in wafer starts last calendar year. We maintain high conviction in ENTG and believe the company is well positioned for greater capex spending on semiconductor equipment in the years ahead. ENTG has a strong ROIC and consistent margin expansion. Any increase in node transitions leading to greater wafer starts (80% of ENTG sales are unit driven) and/or any improvement in the auto/industrial verticals should drive growth in the future.

-

Reduced: Amphenol Corporation (APH) – Trimmed position on strength due to valuation. We remain confident in the outlook for the business, but elected to pair back the position due to elevated valuation.

-

Reduced: CBRE Group, Inc. (CBRE) – Trimmed position after a solid performance from the stock in 2024. We maintain a positive view of the company, but wanted to maintain the position size close to 3% of the portfolio.

-

Exited: BellRing Brands, Inc. (BRBR) – Sold the position following strength in the shares in 2023 & 2024. The stock was a spin off from Post Holdings, but at over 21x EV/EBITDA we felt it was prudent to sell.

Looking Ahead

There is elevated uncertainty as we start the second quarter with a high likelihood of greater tariffs being announced in the weeks ahead. Consumer confidence has declined recently due to the risks of additional tariffs, but the broader economic data still supports growth in the near term, but growth is decelerating. While we are not predicting a recession, the odds of a recession have increased. In terms of monetary policy, the Fed appears to be on a steady course for two or three rate cuts later in the year. The effect of tariffs on both inflation and the broader economy could change those plans though.

Despite the recent correction, the market concentration and valuations remain elevated. History shows that transitions following peak market concentration (e.g. the Nifty Fifty or the Tech Bubble) tend to play out over multiple years—not quarters. The cap-weighted indices may continue to face pressure as investors reassess stretched valuations and excessive positioning. We believe that equity returns in the near term may be modest, with shareholder yield (dividends, share repurchase, debt reduction) comprising a significant percentage of the total return from equities. Defensive portfolios such as ours should be favored areas for investors if recession concerns remain or materialize. Importantly, Quality factors have historically posted their best relative returns during periods of decelerating growth and through recessions. Quality factors typically lag in the early days of a recovery and keep pace during the mid-cycle years. We may be late in the economic cycle now. If that is correct, it bodes well for the relative performance of Quality factors over the next few years and for our portfolios.

Annualized Returns

As of 3/31/2025

Inception date: 3/31/2012. Performance is preliminary. Subject to change. Past performance should not be taken as a guarantee of future results. Net of fee returns are calculated net of a model management fee of 0.75%. Please see the disclosure notes found on the bottom of the page.