Market Observations & Portfolio Commentary

Mid Cap – 2Q2025 vs. Russell Midcap

Market Update

After the significant downturn in the first quarter, U.S. equities experienced a double-digit increase in 2Q. The broader market, as measured by the Russell 3000 Index, increased 11.0%. Volatility surged in early April following new U.S. tariff announcements aimed at reshaping global trade. A double-digit, risk-on rally ensued following a temporary pause in tariff escalations, widespread optimism around enterprise AI, and a healthy earnings outlook. Additionally, improving sentiment, a healthy labor market, and expectations of future Federal Reserve rate cuts further supported the upward momentum, even amidst geopolitical tensions and mixed economic signals. Growth styles led Value, and Large Caps outperformed Small Caps. Turning to market factors, Growth and Volatility posted the strongest returns, and most Momentum factors outperformed. Value and Yield factors had a negative impact, while Quality factors were mixed.

Key Performance Takeaways

-

The London Company Mid Cap portfolio increased 5.7% during the second quarter (5.5% net) vs. an 8.5% increase in the Russell Midcap Index. Both sector allocation and stock selection were headwinds to relative performance.

-

The Mid Cap portfolio produced solid absolute returns in 2Q, but relative results came up short of our 85-90% upside capture expectations. We received limited benefit from our Quality orientation, and our structural underexposure to high-momentum names was a material headwind. While the Index is broader down cap, the absence of owning the Top 10 performers in the Russell Midcap contributed to over 40% of the underperformance this quarter. Pockets of weakness across several holdings further exacerbated relative performance headwinds amidst the risk-on rally. We elected to maintain our position in a few of the weaker positions, reflecting our long-term conviction in the businesses. The recent strength of some of the riskier, more speculative Mid Cap names is not driven by fundamentals nor is it sustainable longer-term. Fortunes can change quickly with a high conviction portfolio, and we remain confident in the operating metrics of portfolio companies.

Top 3 Contributors to Relative Performance

-

Amphenol Corporation (APH) – APH was a top name as it is a beneficiary of AI spending, driven by surging demand for its electronic connectors, interconnect systems, antennas, and sensors used in AI datacenters. As such, the stock has been very strong as of late. We remain positive on Amphenol’s diversified business model, market leadership, and robust balance sheet, which positions it for sustained growth.

-

Dollar Tree, Inc. (DLTR) – DLTR was a top performer after it reached an agreement in March to sell its underperforming Family Dollar business, a decade-long drag on growth and margins. This divestiture has driven a stock re-rating, reflecting a higher-quality company focused on value creation at the Dollar Tree banner. The recent elimination of the de minimis exemption has yielded positive sentiment towards retailers like DLTR. We remain attracted to its pricing flexibility and margin enhancement opportunity.

-

NewMarket Corporation (NEU) – NEU outperformed this quarter, fueled by strong AMPAC revenue growth from better volume and product mix, despite weaker Petroleum Additives results. The planned capacity expansion for the AMPAC business signals robust demand for rocket additives in a stable, oligopolistic market. Management prioritizes debt reduction and shareholder returns through dividends and buybacks.

Top 3 Detractors from Relative Performance

-

Copart, Inc. (CPRT) – CPRT was a bottom performer after reporting softer earnings results with elevated expectations. CPRT has been a top holding in 5 of the last 10 years since holding it in Mid Cap. It has leading market share in all its markets and continues to expand its moat with capacity expansions. The fundamentals and trends remain strong for the business.

-

Entegris, Inc. (ENTG) – ENTG continues to be weak due to challenges from underutilized mainstream fabs, less visibility in older technology, and weaker capex-driven demand. ENTG’s solutions for advanced technology and incremental wafer content gains continue to trend upward. ENTG is one of the most diversified players in the semi-materials industry, with its size and scale. We remain attracted to the industry’s high barriers to entry, limited competitors, and high switching costs.

-

Churchill Downs Incorporated (CHDN) – CHDN has underperformed due to weakness in regional gaming, concern about consumer spending, and lower Derby profitability y/y. We note that the Derby was facing the 150th anniversary last year, and we continue to like CHDN, its highly cash-generative assets, track record of good capital allocation, and opportunities to reinvest in the business at attractive returns.

Sector Influence

We are bottom-up stock pickers, but sector exposures influenced relative performance as follows:

-

What Helped: Underweight in Energy (a weaker performing sector) and overweight in Industrials (a better performing sector)

-

What Hurt: Underweight in Information Technology (a better performing sector) and overweight in Consumer Staples (a weaker performing sector)

Trades During the Quarter

-

Increased: Dollar Tree, Inc. (DLTR) – Added to DLTR following the sale of Family Dollar. Shares of DLTR were very weak in 2023 and 2024 as the company struggled to turn around and/or find a buyer for Family Dollar. Post the Family Dollar sale, we believe DLTR margins could improve while the stock trades at only 9x EV/EBITDA. DLTR will also have a large tax loss carryforward to reduce future taxes.

-

Reduced: Armstrong World Industries, Inc. (AWI) – Trim followed strength in the shares and our desire to manage the position size.

-

Reduced: Post Holdings, Inc. (POST) – Trim followed strength in the shares and our desire to manage the position size.

-

Exited: Skyworks Solutions, Inc. (SWKS) – Sold remaining position reflecting greater competition, client concentration, and recent management changes. We first purchased SWKS in late 2018. Shares of SWKS did well in the early years of our holding period, but the stock underperformed the broader market in recent years. While it is frustrating to sell on weakness, the recent loss of exclusivity on an iPhone 17 component with Apple highlights a significant risk to the firm. Apple represents over 60% of revenue to SWKS, so any change in the relationship is meaningful. This is the second loss of a component used in iPhones in recent years and is a sign of greater competition from large players like Qualcomm and Broadcom. SWKS also recently fired their CEO, which is another risk in the future. We decided to sell based on these concerns.

-

Increased: Churchill Downs Incorporated (CHDN) – Added to the existing position reflecting confidence in the long-term growth story, recent insider purchases, and an attractive valuation (less than 12x EBITDA).

Looking Ahead

There is elevated uncertainty as we start the second half of 2025 with a high likelihood of greater tariffs being announced in the weeks ahead. Consumer confidence has declined recently due to the risks of additional tariffs, but the broader economic data still supports growth in the near term, although growth is decelerating. While we are not predicting a recession, the odds of a recession have increased. In terms of monetary policy, the Fed appears to be on a steady course for two or three rate cuts later in the year. The effect of tariffs on both inflation and the broader economy could change those plans, though.

In terms of the equity market, the S&P 500 is back to the expensive, concentrated territory in which it began the year. Meanwhile, the macro risk backdrop has deteriorated since the start of 2025, including labor market softening, ongoing tariff uncertainty, debt headwinds, geopolitical tensions, and unclear inflation trends. Equity returns in the near term may be modest, with shareholder yield (dividends, share repurchases, debt reduction) comprising a significant percentage of the total return from equities. We believe our high-Quality, low-Volatility orientation positions us well for an environment of elevated policy risks and fragile global growth. We remain rooted to our long-term, fundamental investment approach, focusing on company quality, sustainable returns on capital, and resilience across economic scenarios.

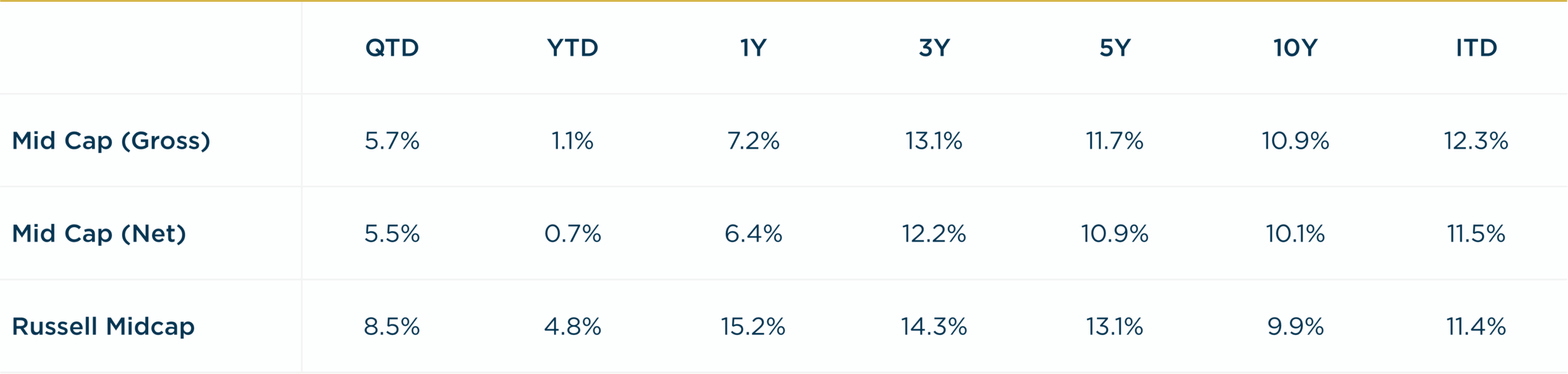

Annualized Returns

As of 6/30/2025

Inception date: 3/31/2012. Performance is preliminary. Subject to change. Past performance should not be taken as a guarantee of future results. Net of fee returns are calculated net of a model management fee of 0.75%. Please see the disclosure notes found on the bottom of the page.