Market Observations & Portfolio Commentary

Mid Cap – 3Q2025 vs. Russell Midcap

Market Update

U.S. equities continued their advance in Q3, fueled by a Fed rate cut, solid corporate earnings and enthusiasm around AI. Economic data released throughout the third quarter was mixed, but the economy retained most of its momentum from the second quarter. Expectations for additional interest rate cuts by the Federal Reserve also drove more optimism in the market. Volatile, high beta stocks extended their sharp rebound off April 8th lows, notching the strongest high beta rally since the bounce off the Global Financial Crisis trough in 2009. For the quarter, the broader market, as measured by the Russell 3000 Index, increased 8.2%, and the S&P 500 and small-cap Russell 2000 both hit all-time record highs. Stylistically, Growth outperformed Value, and Small Cap stocks led Large Caps. Turning to market factors, Volatility and Yield factors posted the strongest returns. Value and Growth factors were mixed. Quality factors, which our portfolios tilt towards, were mostly headwinds.

Key Performance Takeaways

-

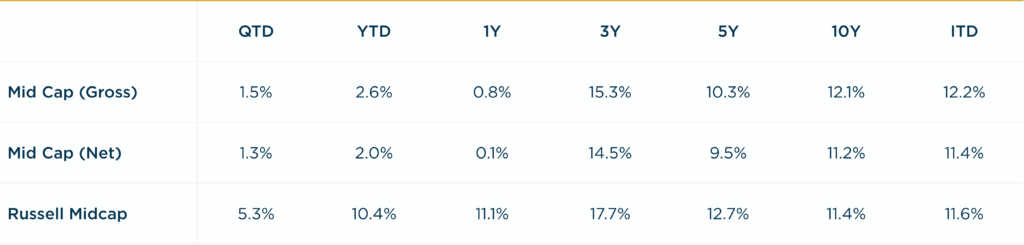

The London Company Mid Cap portfolio increased 1.5% gross (1.3% net) during the quarter vs. a 5.3% increase in the Russell Midcap Index. Both stock selection & sector exposure were headwinds to relative performance.

-

The Mid Cap portfolio trailed the benchmark and came up short of our 85-90% upside capture expectations. There have been pockets of idiosyncratic weakness across the Mid Cap portfolio, but ultimately our high Quality, low Volatility positioning has been out of favor since April 8th. Quality factors, a tailwind during the drawdown earlier in the year, turned into a headwind as Volatility surged. The high beta rally has been driven by low quality, negative earning companies which have rallied on hopes of further Fed rate cuts. The recent weakness by Quality factors is consistent with historical patterns. In the aftermath of recessions or policy shifts, markets often reward speed and speculation over stability. We remain confident in our holdings: durable advantages, strong balance sheets, and steady free cash flow underpin long-term value.

Top 3 Contributors to Relative Performance

-

Somnigroup International (SGI) – SGI was a top performer as it continues to gain incremental share in the bedding market, despite the weakness in the endmarket. The integration of Mattress Firm is progressing ahead of schedule, causing an improvement in the outlook. We believe the business combination has the potential to unlock meaningful value. Our investment thesis is supported by robust free cash flow generation, strong brand equity, and solid management execution.

-

Armstrong World Industries, Inc. (AWI) – AWI shares outperformed in the quarter due to beating expectations, driven by favorable positioning in key verticals and strong operating leverage. We continue to like AWI for its consistent execution, strong financials, leading market share and persistent moats through its exclusivity agreements and warranties.

-

NewMarket Corporation (NEU) – NEU was a strong performer in the quarter, mainly due to three factors. First, low oil prices cut input costs faster than revenue, driving improved profitability. Second, a timely defense acquisition allowed NEU to ramp up production amid global conflicts. Finally, the market is positively viewing the company’s use of cash flow to repay debt.

Top 3 Detractors from Relative Performance

-

Fidelity National Information Services, Inc. (FIS) – FIS have underperformed mainly due to inconsistent execution and a weaker outlook that requires an acceleration later this year. While there is execution risk, the company’s strong market position and recurring revenue base continue to deliver. Management will need to execute to regain credibility with investors. We are attracted to FIS’s durable business model as it maintains a leadership position across its core segments and provides mission critical services to its customers.

-

Allison Transmission Holdings, Inc. (ALSN) – ALSN dipped in early July but has since traded roughly flat. Some trade policy uncertainty has impacted the NA on-highway end-market demand, which has concerned investors. Our conviction on the stock is based on its wide competitive moat and strong management team; we continue to believe that the company has a number of growth opportunities that haven’t been fully realized yet, especially in defense.

-

AptarGroup, Inc. (ATR) – ATR was a bottom performer after extending the recovery in the Consumer Healthcare business and facing harder comps in certain high growth products. All parts of the business showed growth (Pharma, Beauty, and Closures) and margins in the Pharma business are expected to increase this year. We remain attracted to the high switching costs of the Pharma products and long-term contracts.

Sector Influence

We are bottom-up stock pickers, but sector exposures influenced relative performance as follows:

-

What Helped: Overweight Industrials (a better performing sector) & underweight Real Estate (a weaker performing sector)

-

What Hurt: Overweight Consumer Staples (the weakest performing sector) & underweight Communication Services (a better performing sector)

Trades During the Quarter

-

Initiated: Avantor, Inc. (AVTR) – AVTR is a leading provider of mission-critical products and services primarily to the life sciences and biopharma industries. AVTR offers an extensive catalog for research and laboratories, ranging from general laboratory supplies to specialized consumables used in bioprocess manufacturing. AVTR operates as an asset-efficient distribution platform, supported by a high level of recurring revenue (85%). Its products are often specified directly into customer processes, resulting in high switching costs and stable demand. AVTR’s scale, broad product portfolio, and integration into customer workflows with on-site support help reinforce its market position. Over the long term, we believe AVTR is well positioned to benefit from structural trends such as the increasing adoption of biologics, the growth of personalized medicine, and rising global investment in biopharma R&D. While near-term end market weakness has weighed on valuation, we believe this does not fully reflect the company’s resilient business model, competitive advantages, and long-term earnings potential. A recent large insider purchase from a board member gives us greater confidence in our timing, and we remain optimistic about the outlook.

-

Reduced: Amphenol Corporation (APH) – We reduced the position in APH on strength. The stock has done very well over the years and had a great run so far in 2025. We maintain strong conviction in the company, but wanted to reduce the size in the portfolio as the market cap now exceeds $150B.

Looking Ahead

Despite the twists and turns of uncertainty, the U.S. economy has displayed impressive resilience this year. Housing, the impact of recent tariffs, and the labor market continue to be areas of concern. That said, the past six months were filled with powerful catalysts—including tax reform, Fed easing, lower long-term rates, tariff clarity, and record capital spending—which gave new life to risk-taking and economic optimism. Still, sticky inflationary pressures combined with a weakening labor market have complicated the Fed’s dual mandate.

Turning to equities, the markets remain concentrated and expensive, potentially limiting room for multiple expansion and raising the prospect of muted returns with higher volatility. Expectations are being partly driven by productivity gains, broadening of earnings growth, and less restricted monetary policy. Yet, the momentum and sustainability of AI and the capex behind it have been questioned more frequently. High beta rallies, like the past 6 months, are rare, short-lived and historically mean-reverting. In the aftermath of recessions or policy shifts, markets often reward speed and speculation over stability. Quality factors usually lag in these circumstances, then regain leadership when fundamentals reassert themselves. With valuations stretched & speculation abundant, we believe focusing on resilient, attractively valued businesses remains the best path to compounding wealth across full cycles. Our Quality-at-a-Reasonable-Price discipline is designed to protect capital during frothy periods and deliver steadier results when the cycle turns.

Annualized Returns

As of 9/30/2025

Inception date: 3/31/2012. Performance is preliminary. Subject to change. Past performance should not be taken as a guarantee of future results. Net of fee returns are calculated net of a model management fee of 0.75%. Please see the disclosure notes found on the bottom of the page.