Insights from the CIO

Founder, Chairman, and Chief Investment Officer

Perspectives on the Market

Back in 2004, we produced a presentation called ‘The Decade of the Dividend.’ This was in the aftermath of the Tech Bubble market crash, and we highlighted how each decade typically has its theme. In the 1990s, it was all about Growth. In 2004, we made the case why dividends and total return could be the performance leaders of the next decade, following a speculative growth tech led market. As fate would have it, the 2000s were later known as the ‘Lost Decade.’ The Global Financial Crisis (GFC) bookended the perilous decade for equity investors, with a negative total return for the S&P 500. Without dividend reinvestment, the price return for the S&P 500 was even worse.

Fast forward to 2022, we see unique, yet similar circumstances to 2004, and we decided a refresh of the ‘Decade of the Dividend’ was in order. The 2010s saw the era of Quantitative Easing, accommodative monetary policy, and ultra-low interest rates. The wreckage from the GFC resulted in a shallow economic recovery. The unrelenting demand for Growth and access to cheap capital spurred risk taking and buoyed lower quality businesses. Taken together, Growth and robust returns were the hallmarks of the 2010s. We view a repeat of double-digit returns in the 2020s as unlikely. We believe dividends will enjoy a resurgence and become an increasingly important component of investors’ total returns in the years ahead.

6 Reasons Why Dividends Will Be Key this Decade

1. The Potential for Lower Returns Could Mean Dividends’ Contribution to Total Return Reverts to Historical Norms.

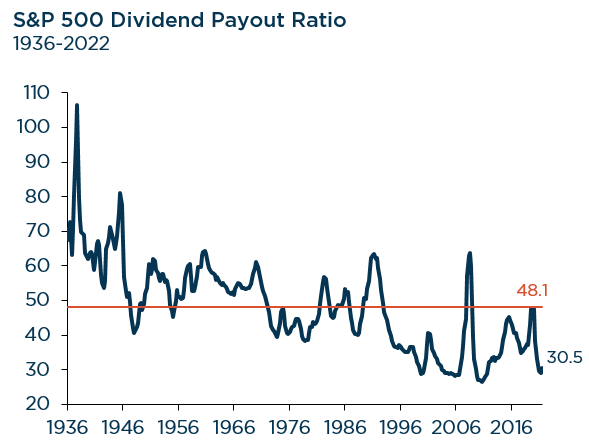

Historically, dividends have averaged almost 60% of the market’s total return going back to the 1930s. Dividends played a large role in terms of their contribution to total returns during the 1940s, 1960s, and 1970s, decades in which annualized total returns were lower than 10%. By contrast, dividends played a smaller role during the 1950s, 1980s, and 1990s when average annual total returns for the decade were well into double digits. Over the past decade, dividends have contributed less than 25% of the S&P 500’s total return, as years of low interest rates helped inflate asset valuations.

Source: Strategas. Data as of 6/30/2022. Past performance should not be taken as a guarantee of future results.

Today, investors are facing persistently high inflation levels and expectations for tighter monetary policy—limiting the prospects for multiple expansion. Additionally, equity valuations remain above long-term averages. This leads us to believe that equity returns going forward could be more modest than the prior decade and dividends may be a significant part of investors’ total return from equities.

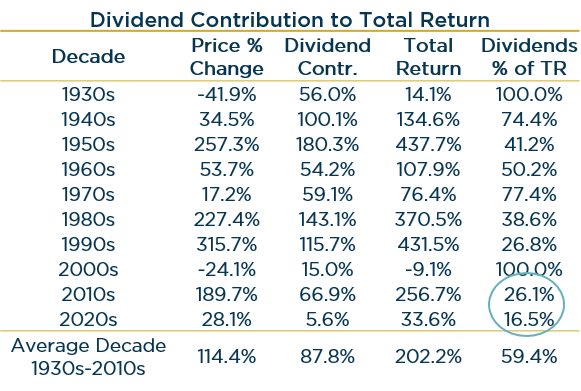

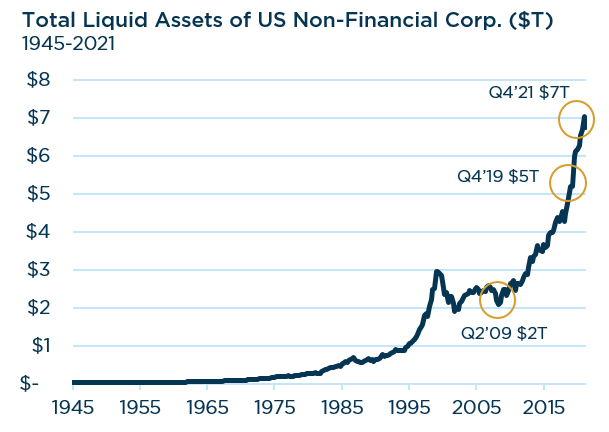

2. Dividends Poised to Increase Given High Corporate Cash Balances & Historically Low Payout Ratios.

Fundamentals for the higher quality sub-set of corporate America are strong today and conditions are supportive of dividend growth in the years ahead. Cash on corporate balance sheets has more than tripled since the early 2000s. Profit margins remain elevated and free cash flow is strong.

Source: St. Louis Federal Reserve. Past performance should not be taken as a guarantee of future results.

Historically, the dividend payout ratio (% of corporate profits paid out as dividends) for the S&P 500 has averaged 48%. Currently, the payout ratio is 31%–leaving plenty of room to increase dividend payments in the years ahead. Further, with equity market valuations above their long-term averages, we believe management teams may be inclined to focus more on dividend growth as a means of rewarding shareholders in the near term, as opposed to buying back stock at lofty valuations.

Source: Strategas. Past performance should not be taken as a guarantee of future results.

3. Inflation Reduction Act Could Incent Companies to Place Greater Emphasis on Dividends vs Buybacks.

As part of the recently passed Inflation Reduction Act, a 1% surtax on share repurchases is set to take effect in 2023. S&P 500 companies have spent ~$6 trillion on stock repurchases over the past 10 years, ending 2021. This compares to ~$4 trillion spent on dividends. With the new 1% excise tax on repurchases, the excess capital allocated to buybacks may be redirected to dividends. While it may not lead to a material shift in behavior, it will probably encourage companies to shift more toward raising the normal dividend or paying special dividends.

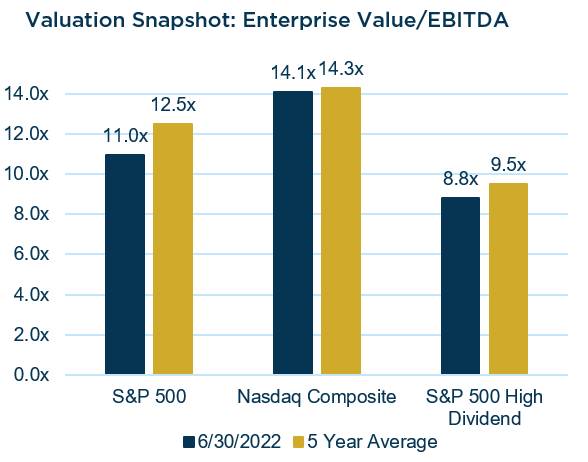

4. Valuations for Dividend Paying Companies Remain Attractive.

The low rates and risk-on environment of the past few years resulted in the rapid expansion of valuation multiples for non-dividend paying and speculative growth companies. Meanwhile, dividend paying companies, as measured by the S&P 500 High Dividend index, did not participate as fully in the Growth driven market. Even with the latest market drawdown, both the S&P 500 and NASDAQ trade above their 20-year average EV/EBITDA multiples, 9.6x & 10.6x respectively.

Source: Piper Sandler. Past performance should not be taken as a guarantee of future results.

Valuation alone is not a great predictor of leadership change or short term returns, but it does matter to performance results over longer-term, full market cycles. We believe the combination of current income and compelling valuations for quality companies that pay a sustainable and growing dividend will be a significant advantage for relative returns this decade.

5. Strong Risk/Reward Track Record Poised to Help Mitigate Elevated Volatility.

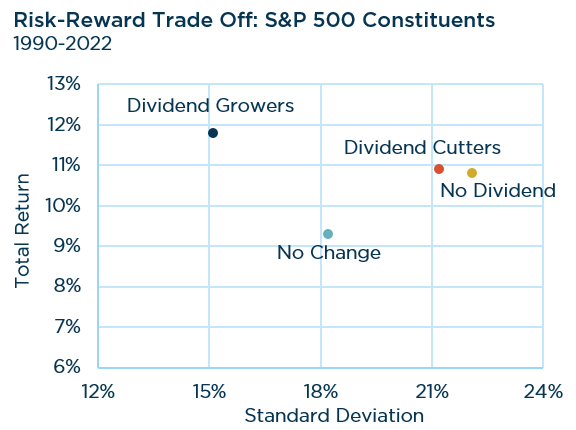

Companies that pay sustainable and growing dividends typically provide an attractive combination of earnings and cash flow growth potential, healthy balance sheets, and management teams that are prudent allocators of capital. Together, these attributes have historically offered a compelling risk-reward trade off with competitive performance during up markets and risk mitigation during drawdowns and market volatility.

Source: Strategas; FactSet. Past performance should not be taken as a guarantee of future results.

Investors today face a complex market landscape. As central banks raise rates and the Fed unwinds its balance sheet, they’re soaking up liquidity in the financial system, which is having a destabilizing impact on capital markets. Moreover, higher and more variable inflation may continue to exacerbate market stress. Companies that provide a combination of strong capital flexibility and growing dividend payments may help buffer against market volatility in the years ahead.

6. The Continued Search for Yield Should Support Dividend Paying Companies.

Individuals and institutions alike have income requirements, and that has been difficult to find in a world of low interest rates and bond yields. Even as interest rates have begun to rise, they are still low by historical standards. Meanwhile, the demand for yield is high, supported by structural dynamics (e.g. aging populations).

Dividend paying stocks continue to offer attractive yields relative to many fixed-income asset classes. Given expectations for an extended period of higher inflation, a dividend growth-oriented portfolio may also provide a slight hedge against rising costs while providing an attractive level of income with potential for growth. Taken together, we expect dividends to remain especially relevant to investors in the years ahead.

In Summary

Given the inflationary backdrop and reset of monetary policy, we believe it’s unlikely the next 10 years will see a repeat of the past decade’s double-digit annualized returns. Further, we don’t expect a repeat of low, stable inflation this decade, and that may foster greater equity market volatility.

We believe dividend paying stocks are well-positioned in the current environment, offering reasonable valuations and a compelling track record of risk mitigation. Additionally, dividends appear poised to increase in the years ahead, given historically high cash balances and low payout ratios across corporate America. Dividends have historically played a significant role in total return, particularly when average annual equity returns have been lower than 10% during a decade. While we’re not calling for another “Lost Decade,” we do believe that multiple expansion may be challenged in the years ahead as the Fed begins to normalize policy. The potential for lower returns could mean dividends’ contribution to total return reverts to historical norms.

A diversified portfolio of quality companies that pay a sustainable and growing dividend can provide investors with an opportunity to participate in market gains, but also provide some protection if market fundamentals deteriorate. The combination of strong capital flexibility and growing dividend payments may also help mitigate inflationary pressures and the impact of higher interest rates down the road.

Income Equity

See the latest performance data