Insights from the CIO

Founder, Chairman, and Chief Investment Officer

Perspectives on the Market

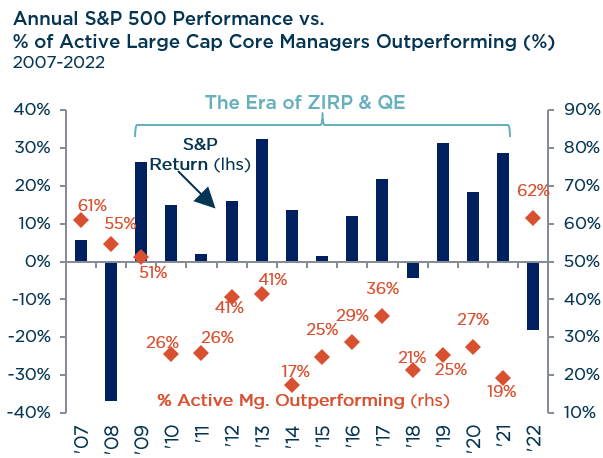

On multiple fronts, 2022 was unlike any market environment we’ve seen in well over a decade; but more importantly, the 10+ years preceding 2022 was more of the exception than the norm. In 2022, investors faced the most prolonged market selloff since 2011 and the S&P 500 notched its worst annual decline since 2008’s Global Financial Crisis (GFC). On the other hand, 2022 was one of the best years for active managers since 2008. To us, there is a common thread that connects these dynamics. For all intents and purposes, the period from 2009-2021 saw extremely accommodative monetary policy—it was the era of Zero Interest Rate Policy (ZIRP) and Quantitative Easing (QE). This prolonged stretch of experimental, emergency level Fed intervention had many byproducts and led to unique distortions across capital markets. When interest rates were at rock bottom levels and inflation was low and stable, the playbook for attractive returns was simpler. Investors who previously embraced ‘don’t fight the Fed,’ ‘buy the dip,’ and TINA (‘there is no alternative’ to stocks) were rewarded. Downside protection proved to be a luxury rather than a necessity during this stretch of historically low volatility.

It took generationally high inflation to break that fever and end this accommodative monetary posture. Now that the decade of abnormally suppressed interest rates is over and the cost of capital is on the rise, we believe investors should pay much closer attention to risk. Should the next decade more closely resemble a period of interest rate normalization & elevated volatility, we believe a higher quality approach to investing could stand out in a meaningful way.

4 Reasons Why Risk Management Will be Key in the Years Ahead

1. The cost of money matters once again, and it will likely shape the contours of the investment landscape for years to come.

The 10+ years of abnormally suppressed rates disrupted the normal function of capitalism. Ultra-low rates pushed many investors further out the risk curve to achieve yield objectives. Plus, abundant access to cheap debt helped prop up lower quality, unprofitable companies. Among the distortions, we saw correlations rise and dispersion fall across equities; meanwhile, broad market volatility declined and there was a dearth of down markets relative to historical norms. Generally speaking, such conditions weren’t favorable to active managers tasked with price discovery and risk mitigation. Incidentally, it was during this period that passive investment vehicles hit their stride. In 2008, the mix of total equity assets in active versus passive vehicles was 76% and 24%, respectively. At the end of 2022, that mix had shifted to 45% active and 55% passive. Low rates fostered multiple expansion and a lack of down markets rewarded passive investors with attractive, double-digit returns.

Fast forward to 2022, the ‘Don’t fight the Fed’ playbook, which thrived following the GFC, was flipped on its head. The cost of capital spiked and the competition across risk assets sharply increased. This normalization of monetary policy helped reset the playing field and upend some of the market dynamics that had been headwinds for many fundamental active managers.

Source: Strategas & Bloomberg. Past performance should not be taken as a guarantee of future results.

To quote Jason Trennert, CIO of Strategas, we believe “the days of an ‘everyone gets a trophy’ cost of capital are over.” In our view, the monetary policy regime change, including the transition from Quantitative Easing (QE) to Quantitative Tightening (QT), will have broad implications for long-term multiple expansion, stock selection, and risk. Higher quality companies, those with durable profitability, strong balance sheets and the ability to self-fund their operations, will likely have a structural advantage in the years ahead.

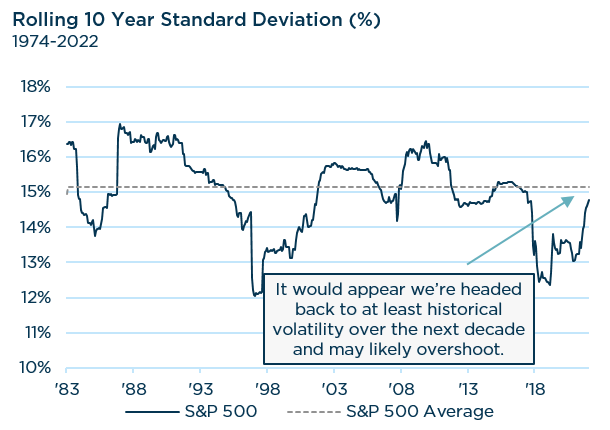

2. As rates normalize, we could see volatility levels head higher, reverting toward historical averages.

Volatility tends to come in cycles. During the ZIRP & QE era, the rolling standard deviation for the S&P 500 dropped far below historical averages. Said another way, the range of returns for the S&P 500 was historically tight and not very volatile, relative to its own history. We believe monetary policy was a contributing factor to this phenomenon. When there is excess liquidity in the system, it tends to look for a place to invest. A lot of money chasing any small moves in price can effectively reduce volatility. When liquidity is removed from the system, it can have the opposite effect, as we saw in 2022. Increases in volatility and pricing dislocations tend to favor fundamental active managers.

Source: Zephyr. Past performance should not be taken as a guarantee of future results.

3. In an environment of modest returns & elevated volatility, downside risk mitigation can be a major factor in total return and wealth preservation.

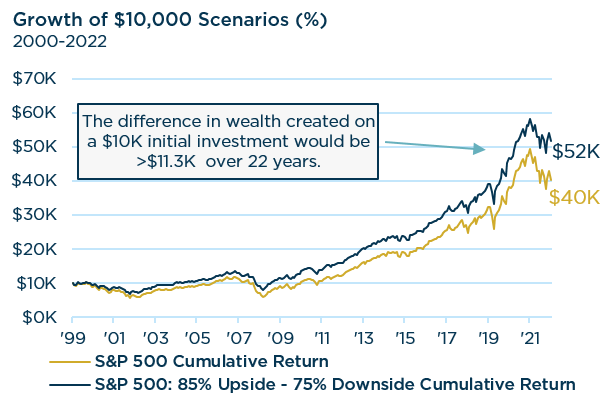

Our goal at The London Company is to outperform the broader market over full market cycles with lower risk, and we approach this mandate by focusing on downside protection. Our quality-oriented approach is more conservative, so we recognize that our portfolios will often lag the broader market during a rally. However, the effects of protecting client assets in negative markets have had a far greater impact on our portfolios’ total return and alpha generation than high upside capture.

With that in mind, we believe investors should be familiar with the concept of upside capture (USC) and downside capture (DSC). Investing in an index effectively means investors experience 100% of the upside and 100% of the downside. By comparison, we aim to capture 85-90% of the market’s upside but only 75-80% of its downside. In simple terms, it is winning by losing less. Admittedly, this isn’t easy in practice, and it’s also worth noting that the broader market historically has traded higher on a monthly basis ~2/3 of the time. So, it’s not uncommon for our portfolios to underperform their benchmarks the majority of the time. Even still, the power of downside protection should not be overlooked. Remember, if your portfolio suffers a 50% drawdown, you need a 100% return just to get back to even.

To illustrate this point, in the table below, we have the performance and risk characteristics of two scenarios—the standard S&P 500 and a hypothetical 85% USC/75% DSC version of the S&P 500. The hypothetical version would have outperformed the standard index over the past 30 years with much lower volatility. The benefits of this approach are even more pronounced during periods of higher volatility – like starting in 2000.

Source: Zephyr. Past performance should not be taken as a guarantee of future results.

In the atypical decade preceding 2022, capturing 100% of the market’s upside and downside worked out well, because it was a robust, double-digit return environment with a historical dearth of down markets. These conditions were a headwind to our style of investing, but we don’t think the next 10 years will look like the last 10 years. We believe reasonable participation in market advances will be important, but limiting downside capture in market downdrafts could be key to total returns and reducing portfolio risk in the years ahead.

Source: Zephyr. Past performance should not be taken as a guarantee of future results.

4. Elevated levels of risk in a portfolio can have major indirect costs.

An often-overlooked benefit of lower standard deviation in a portfolio is higher realized investor returns. We all know the expression ‘time in the market beats timing the market.’ While true, in order to reap the full benefits of compounding, it is important to remain disciplined and stay the course—something easier said than done. Each year, Morningstar publishes their Mind the Gap report which analyzes investor returns versus actual returns over the prior ten years. To measure investor returns, they look at the dollar-weighted returns taking into account when investors were investing and when they were selling. Unfortunately, the results show investor returns for US equity funds and ETF’s are consistently lower than the actual returns for the products. In the just published 2022 report, the gap for US equity vehicles was -1.2% for the past 10 years ending 2021, showing that investors routinely mistime buys and sells, reducing their actual return.

Another interesting finding from the report is that the gap between investor returns and actual returns for US Equity fund and ETF’s is higher among funds with higher standard deviation. For example, the gap for equity funds in the lowest quintile of standard deviation is -1.1%. The gap for the highest quintile of standard deviation is -1.5%. Bottom line—it is more emotionally difficult for investors to remain invested in higher standard deviation funds and ETF’s given the increased volatility, thus negatively affecting their actual return.

In Summary

Taken together, the risk backdrop has meaningfully shifted and the competition for capital has sharply increased. In our view, the bar has been raised, and the easy gains are now in the rearview mirror. Going forward, we believe carefully balancing risk with reward will be the playbook for success. As we’ve highlighted, there are two very obvious benefits to an approach that prioritizes downside risk mitigation. First, over the long term, an approach that captures most of the market’s upside and meaningfully protects on the downside (e.g. the 85% USC/ 75% DSC scenario), can provide better overall returns and create more wealth with lower standard deviation. Secondarily, there is a behavioral benefit. Investors are more likely to remain invested in lower volatility strategies versus those with much higher standard deviation, helping them achieve the full benefits of compounding. Not to mention, an additional benefit of disciplined, long-term investing is lower portfolio turnover which can improve tax efficiency.

Looking ahead, rates are normalizing after a decade of record lows and inflation may be higher and more variable going forward. The cost of capital is on the rise and nearly 50% of the S&P 1500’s debt matures in the next five years—when refinancing will likely be much more expensive. Multiple expansion may be challenged and volatility could trend higher. Historically, such conditions are favorable to fundamental active managers who prioritize risk mitigation. We believe investors will be rewarded over the coming decade by taking a long-term approach that prioritizes quality and risk mitigation, which can help dampen volatility and protect capital when it matters most.

View Our Strategies

See the latest performance data