Insights from the CIO

Founder, Chairman, and Chief Investment Officer

Investment Takeaways

-

“What have I become?” is a simple, yet powerful lyric from the song Hurt that neatly captures today’s equity market, where familiar benchmarks no longer resemble their former selves.

-

The S&P 500 has transformed into a concentrated mega-cap bet, weakening the case for diversification.

-

Down-cap indices have shifted toward leverage and lower quality, creating a different kind of hidden risk.

-

As leadership begins to broaden, fundamentals are poised to regain influence, rewarding companies with resilient economics rather than those lifted by the last cycle’s tailwinds.

-

Active, selective investing offers a path forward, helping investors avoid unintended index risks and benefit from any broadening in market leadership.

Perspectives on the Market

Johnny Cash’s haunting rendition of the song Hurt includes a simple, devastating question: “What have I become?” It’s a question of identity, transformation, and realizing that the path you’ve traveled may no longer resemble the one you intended. It is also an apt question for today’s equity market.

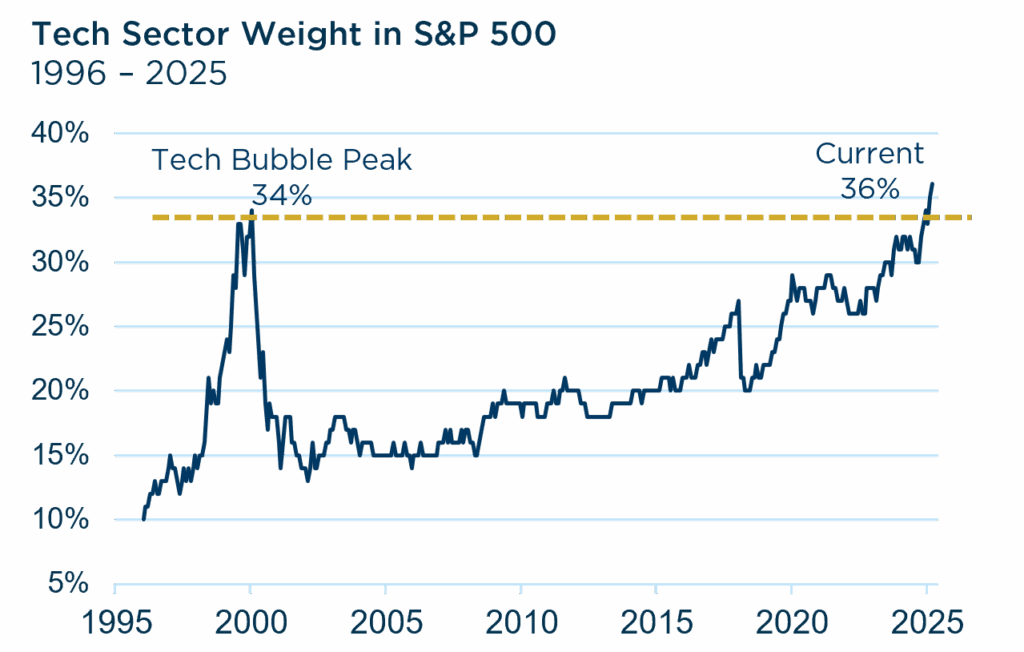

Over the last decade, major U.S. benchmarks have changed in ways many investors may not fully appreciate. The S&P 500 has become increasingly concentrated, growth-tilted, tech-dominant, and expensive. What was once a diversified cross-section of corporate America has evolved into a narrower bet on a small handful of mega-cap technology companies.

A similar shift has occurred across the down-cap universe. Many mid- and small-cap index exposures now carry weaker balance sheets, lower profitability, and more speculative business models. Large-cap passive strategies have become “bubble catchers,” and down-cap indexes increasingly resemble retail casinos.

These changes raise a fair question: Do passive investors truly know what is inside their portfolios? Indexing has long been marketed as diversified, steady, and timeless. Today’s exposures are anything but.

Source: Piper Sandler & S&P Global. Date from 8/30/1996-10/31/2025. Past performance should not be taken as a guarantee of future performance.

How We Got Here

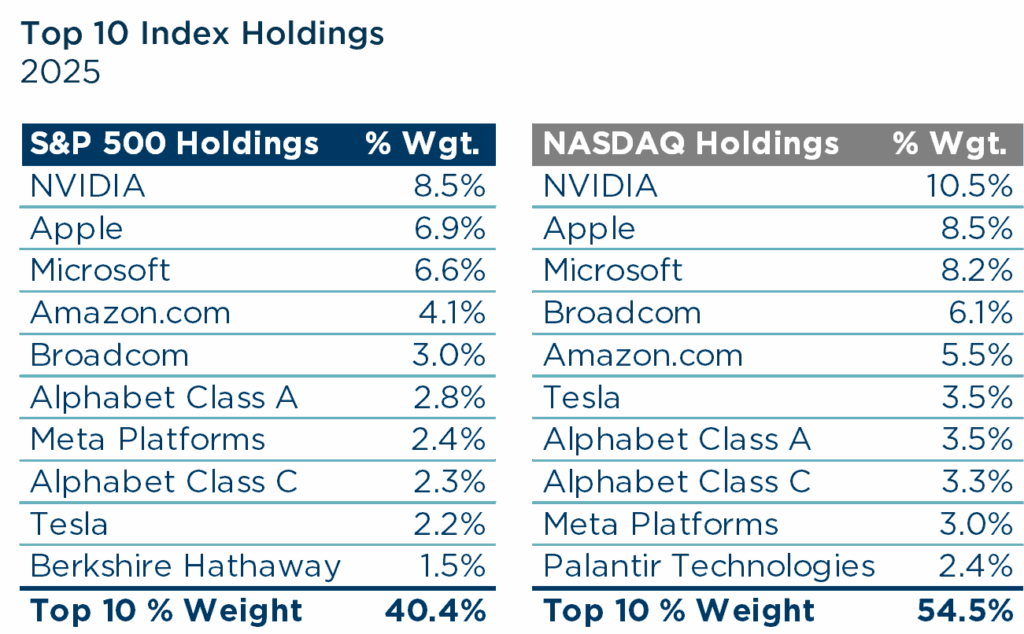

The past decade rewarded companies with dominant share, scale advantages, and rapid innovation. These traits captured investor enthusiasm and created a powerful feedback loop, funneling capital into a narrow group of leaders. As a result, the weight of the Top 10 holdings in the S&P 500 sits at all-time highs, and those names nearly mirror the largest positions in the growthy Nasdaq index. Even the biggest dividend-growth indexes overlap heavily with the same mega-cap names.

Source: FactSet. Data as of 10/31/2025. Past performance should not be taken as a guarantee of future performance.

This growing similarity weakens the diversification argument for passive exposure. When many “different” strategies arrive at the same destination, risk increases. Meanwhile, valuations have risen as momentum outpaced earnings, heightening both return potential and vulnerability.

None of this guarantees an imminent reversal. Enthusiasm can run farther and longer than expected. Still, elevated concentration raises the stakes. All cycles eventually remind us trees do not grow to the sky.

Down-Cap Indices: A Different Kind of Risk

While large-cap benchmarks have consolidated around a narrow set of winners, the small- and mid-cap segments have drifted toward the opposite end of the quality spectrum. Across down-cap indices, the share of expensive, unprofitable, and leveraged businesses has risen meaningfully in the past five to ten years.

Source: FactSet. Data from 10/31/2015 & 10/31/2025. Past performance should not be taken as a guarantee of future performance.

Meanwhile, the middle of the market has thinned dramatically. The share of companies between $10B and $50B in the Russell 3000 has declined by roughly half over the past decade and now represents just 15%. This once-productive segment of consistent compounders is now underrepresented in many portfolios.

In effect, the passive large-cap experience has become a concentrated growth bet, while the passive down-cap experience has become a volatile, low-quality bet. When both sides of the barbell carry elevated risk, the illusion of diversification becomes fragile.

The Case for Selectivity in a Changing Market

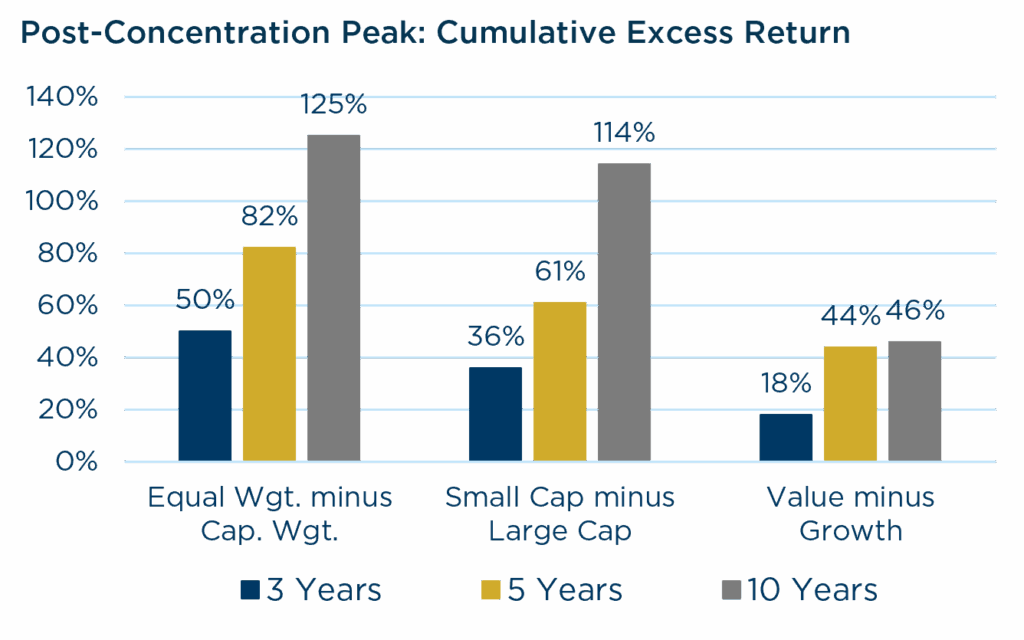

Leadership cycles have a habit of humbling certainty. What works for a decade rarely carries the next one. Historically, concentration peaks have marked a turning point in market leadership. Following the concentration peaks in 1932, 1957, 1973 & 2000, the ‘average’ stock, smaller companies, and value-oriented strategies outperformed the largest names. These shifts were clear in hindsight, though far less obvious in real time.

Source: BofA Global Research. *Please see disclosures notes on the last page for more details. Past performance should not be taken as a guarantee of future performance.

A potential broadening in leadership may create renewed opportunity down the market-cap spectrum, but it does not guarantee better returns. It simply revives the importance of choice. Quality within many down-cap indices has weakened after years of unusually cheap financing. Today’s more normal cost of capital raises the bar for business quality. Large portions of corporate debt will be refinanced at higher rates, which could pressure capital spending, reduce hiring, and place stress on companies with limited financial flexibility.

This environment underscores the role of thoughtful active management. When passive portfolios converge around the same exposures, true diversification requires looking different. Higher active share can help investors own businesses positioned for the next phase of the cycle rather than the last. Selectivity should matter once again.

In Summary

Markets have changed. The S&P 500 has become more concentrated, more expensive, and more tech-dependent. Down-cap indices have tilted toward weaker, more speculative companies. For many investors, this is not what they signed up for.

Our answer is to stay grounded in what works across cycles: Quality at a Reasonable Price. This approach has helped us pursue competitive returns while emphasizing downside resilience. We expect leadership to broaden over time, creating opportunity beyond today’s dominant mega-cap universe. Our goal is to help investors reach their long-term objectives while avoiding the unintended risks embedded in today’s passive indices.

View Our Strategies

See the latest performance data