Insights from the CIO

Founder, Chairman, and Chief Investment Officer

Investment Takeaways

- We prioritize long-term value creation over short-term gains, so we’re often led to family & founder-owned businesses where a generational perspective and significant ownership stakes lead to an alignment of interests.

- Family & founder-owned businesses can offer many benefits, including stronger balance sheets, attractive revenue growth & margins plus capital allocation decisions that prioritize sustainable value creation.

- A routinely overlooked benefit of a low-turnover approach is that it can allow investments to efficiently reap the full benefits of compounding by minimizing the impact of taxes and transaction costs.

- Stability and delayed gratification are principles that aren’t always the trendiest or most popular with the crowd, but the long-term historical track record has shown that they never go out of style.

Perspectives on the Market

At The London Company, we share a fundamental belief with successful family & founder-owned businesses — a long-term, generational perspective is key for value creation and building lasting wealth.

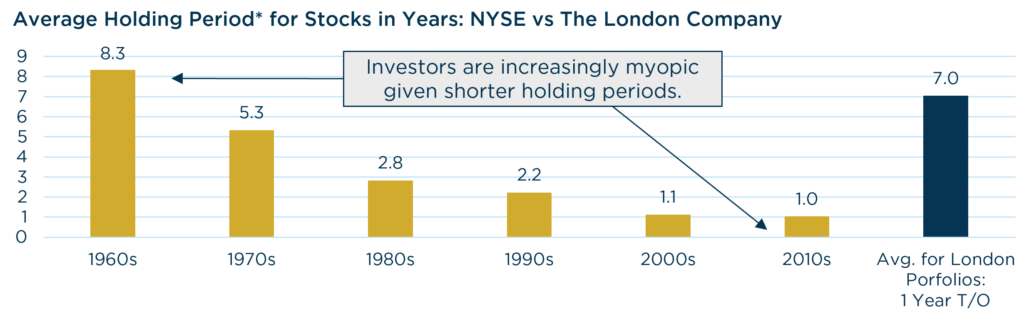

That long-term perspective is increasingly rare in today’s investment landscape. We see this in the average holding period of most investors, which is now measured in months, not years. Such impatience can hinder the realization of long-term value creation. Further, shorter holding periods magnify the importance of being right on the direction and timing of the business cycle.

It’s not just investors though; the majority of publicly traded companies are led by non-family executives that often lack strategic long-term vision or are incentivized to be short-term oriented. Instead of having large, direct equity ownership, many executives are granted options that reward short-term performance goals and often dilute existing shareholders. Unfortunately, greed, self-dealing, and short-termism by management and boards can have consequences for the long-term success of the business, its workers, and shareholders. A classic example being Apple, when Steve Jobs, Co-Founder of Apple, was fired by the board due to disagreements over the direction of the company. Professional management took over, and, without Jobs’ visionary leadership, they nearly destroyed the company. Jobs ultimately returned and went on to make it one of the largest, most profitable companies in the world.

In our view, there are many advantages to investing in family & founder-owned companies, but chief among them is the alignment of interests with long-term investors. A generational focus often leads to more conservative financial management and strategic decisions that prioritize sustainability over rapid growth. We believe such qualities will be needed once this current momentum-driven rally eventually peters out.

Long Game in a Short-Term World: Advantages of Family-Owned Businesses

Across The London Company portfolios, we own many family owned businesses that have maintained a large family ownership, despite being publicly traded. Some examples include Berkshire Hathaway, Paychex, Starbucks, Charles Schwab, FedEx, Old Dominion Freight, Copart, Brown Forman, and NewMarket among others.

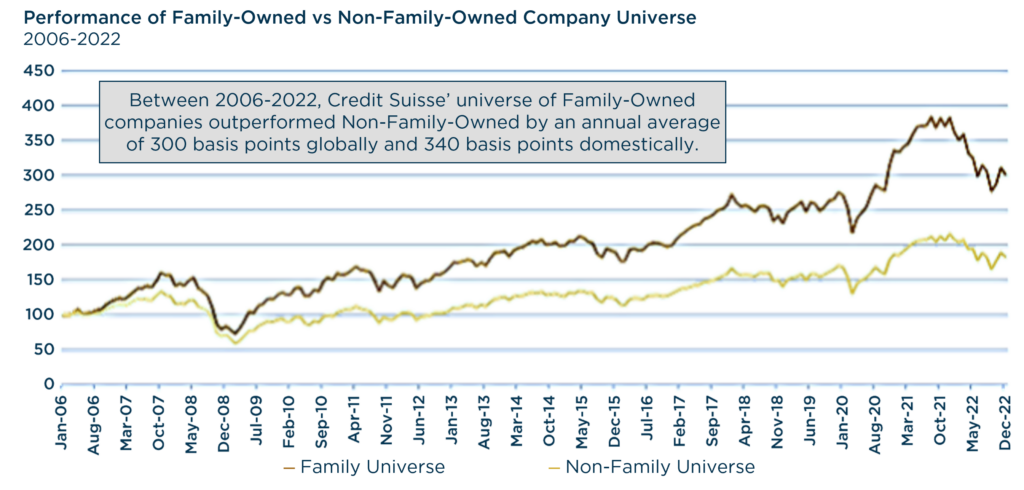

Over time, family & founder-owned businesses can produce some of the best stock market returns. Credit Suisse developed its own, proprietary database of more than 1,000 publicly listed family companies, the ‘Family 1000.’ Between 2006-2022, the overall universe of ‘Family-owned businesses’ outperformed non-family-owned companies by an annual average of 300 basis points globally and 340 basis points domestically.

So, why do we like family-owned businesses?

- Long-Term Focus: Family companies are often passed on for generations, so decisions are made with a long-term mindset, not a short-term EPS goal.

- Large Ownership Stake: With significant “skin in the game,” family businesses typically have the vast majority of their net worth invested in the company, resulting in a strong incentive to make decisions that ultimately benefit their business and shareholders.

- Stronger Balance Sheets: Family owned businesses tend to carry lower leverage. Per Credit Suisse’s study, the median net debt to EBITDA ratio of 1.0x reflects a considerably lower debt burden than 1.2x for non-family businesses. This financial strength gives the management teams greater flexibility. It can also be an advantage during a recession.

- Consistently Higher Margins: Over the same period, the Credit Suisse study pointed to higher margins for family owned businesses. This likely reflects greater spending over time to maintain the moat of the business.

- Better Capital Allocation: Family-owned businesses tend to invest back into the business at a higher rate than non-family owned. R&D spending and capital spending (PP&E) are both typically higher.

- Attractive Revenue Growth & Value Creation: According to Credit Suisse, family businesses typically deliver better revenue growth on average compared to non-family businesses. Moreover, family businesses tend to boast higher cash flow returns on investment compared to non-family firms.

- Less Option Dilution: The incentive structures of family-owned businesses place greater emphasis on productive, long-term capital allocation plans and prudent share count reduction. There tends to be less stock-based compensation that dilutes existing owners’ claim on earnings.

Source: Sources: Credit Suisse Research, Refinitiv. Past performance should not be taken as a guarantee of future results.

The Case Against Market Timing

We don’t need to look back far to see the futility of market timing and predictions. 2023 began with clear calls for an impending recession. Nevertheless, stocks defied rate hikes, wars, and collapsed banks. Few anticipated that a mania over artificial intelligence would help power stocks to new heights.

We don’t chase the ups and downs of the risk trade; instead, we commit long-term capital to companies that have greater control over their own destiny. Often business decisions that promise long-term value, come at the cost of short-term performance. It might be investing in an overseas expansion which is dilutive to near term earnings, keeping margins low to deter competitors, increasing advertising spend to maximize long-term customer value or increasing R&D spending which has potential long-term benefit. In our experience, many family & founder-owned companies share our bias towards patience and recognize the benefits of reinvesting for long-term gain.

As Charlie Munger famously said, ‘The big money is not in the buying and the selling but in the waiting.’ We echo this philosophy, as do many of the family & founder-owned companies we invest in. That mantra, however, is increasingly rare in practice. In fact, the average holding period for a NYSE-listed stock has dropped from 8.3 years in the 1960s to less than 1 year more recently. At The London Company, we take the road less traveled, as evidenced by the 7-year average holding period of businesses in our portfolios. Aside from the improbability of successfully timing the market, we believe there are other significantly important considerations that are routinely overlooked. In particular, a low turnover approach can allow investments to efficiently reap the full benefits of compounding by minimizing the impact of taxes and transaction costs.

Sources: Strategas & FactSet. *Holding Period Proxy = 1/turnover. Data for The London Company portfolios as of 12/31/23. Past performance should not be taken as a guarantee of future results.

In Summary

So, when will the market cycle turn? We can’t predict that, nor will we try. We remain focused on the only timeframe that matters: the long term. That isn’t always easy to do, especially in our highly connected world that amplifies short-termism. Our approach is built on investing in companies with strong returns on capital, under-levered balance sheets, consistent cash flow generation and high shareholder yields — all to help mitigate risk and offset market volatility. Paired with a long-term focus, this approach can lead to greater tax efficiency and more sustainable value creation.

Like many family & founder-owned businesses, we believe in the power of stability and delayed gratification. While these principles aren’t always the trendiest or most popular with the crowd, the long-term historical track record has shown that they never go out of style.

Stability and delayed gratification are principles that aren’t always the trendiest or most popular with the crowd, but the long-term historical track record has shown that they never go out of style.

View Our Strategies

See the latest performance data