Market Observations & Portfolio Commentary

International Equity – 4Q2025 vs MSCI EAFE

Market Update

Global equity markets capped off a strong year with a Q4 rally across both developed and emerging markets. In developed markets, MSCI World index gained 3.1%. International and Emerging markets bested the U.S. markets with the MSCI EAFE and MSCI EM posting 4.9% and 4.7% returns, respectively; meanwhile, the S&P 500 returned 2.7% during the period. Currency movements proved to be a tailwind for the international markets in Q4 and throughout the year.

Within equity markets, Europe led Asian markets in Q4. MSCI Japan returned 3.2% and MSCI China fell -7.3%; meanwhile, MSCI Europe reported a strong 6.2% return. Stylistically, Value led Growth during the quarter. Looking at sectors, Financials had another strong quarter, up 7.7% and contributing about 40% of the MSCI EAFE’s Q4 return. The next largest contributor was Health Care, returning 9.7%, as the out-of-favor sector bounced on the better than feared outcome related to the U.S. administration’s most-favored-nation (MFN) drug pricing policies. Six of the eleven sectors underperformed in the quarter, but Communication Services stood out as the lone negative sector, reflecting a number stocks getting hit on mounting AI disruption concerns. Turning to market factors, the Value, Yield, Size, and Momentum factors were positive contributors during Q4. Growth & Volatility factors were mixed; meanwhile, Quality factors faced headwinds.

Key Performance Takeaways

-

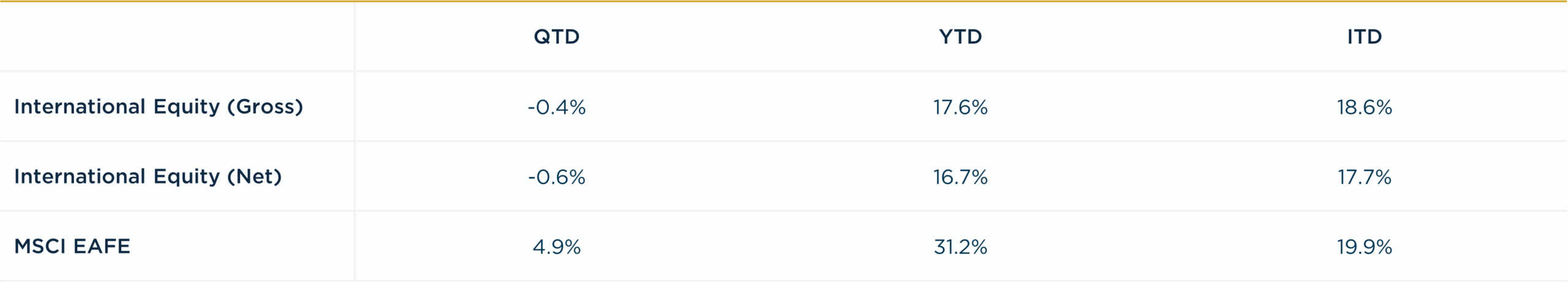

The International Equity portfolio declined 0.4% gross (-0.6% net) during 4Q vs a return of 4.9% for the MSCI EAFE index. Sector exposure & stock selection were headwinds to relative performance.

-

The International Equity portfolio trailed its benchmark, and came up short of our 85-90% upside capture expectations in Q4. Value factors led Quality in Q4. Across the Value factor categories, cheaper stocks, based on valuation multiples, outperformed those with stronger cash flows—which our Quality-oriented portfolio tilts toward. Beyond factor headwinds, sector exposure continued to be an obstacle during the quarter, and our lack of direct bank exposure was a material opportunity cost in Q4 and 2025 overall.

-

In our view, this is a market where discipline matters more than bold forecasts, and portfolios should be prepared for a wider range of possible outcomes. We believe our Quality-at-a-Reasonable-Price approach is well positioned to offer participation in market upside while providing the differentiation that may matter most if volatility increases or leadership shifts.

Top 3 Contributors to Relative Performance

-

Roche Holding Ltd (ROG SW) – The global pharmaceutical company was a top contributor with a 27% gain during the quarter. ROG SW benefited from macro and micro developments. On the macro front, the U.S. administration’s most-favored-nation (MFN) pricing policy was less punitive than feared. On the micro front, positive developments in ROG SW’s development pipeline, especially on potential blockbusters Fenebrutinib and Giredestrant, defied market skepticism.

-

InterContinental Hotel (IHG LN) – IHG LN shares were a top contributor with a 16% return in the quarter. Management reported strong performance and reiterated full year guidance, shaking off fears of a slowing consumer. We remain attracted to IHG LN’s franchise-fee model, providing high ROIC, low capital intensity and compelling downside protection.

-

Assa Abloy (ASSAB SS) – ASSAB SS, the Sweden-based global locks and closures business, was a top contributor. Despite weak residential activity in the U.S., the company reported growth and earnings in line with our expectations, affirming our thesis in the defensive nature of the business. We believe the stock continues to offer an attractive risk/reward balance.

Top 3 Detractors from Relative Performance

-

Nintendo Co Ltd (7974 JP) – 7974 JP stock fell during the quarter but remains positive for 2025. Stock volatility at the beginning of a console cycle is normal, as data and estimates evolve. In Q4, rising memory chip prices was an acute concern for investors. We are encouraged that the company’s hardware is not a loss-leader, unlike other console makers, and we expect its highly profitable software business to drive record profits for Switch 2 over the cycle.

-

BAE Systems PLC (BA/ LN) – BA/ LN shares declined 17% during the quarter, but the stock still remains our top contributor for the year. While underlying performance remains robust, market sentiment on defense companies shifted during the quarter, with developments in the Ukraine-Russia war. In the short-term, we would expect volatility around developments in Ukraine, but we believe defense spending across NATO member countries will be robust over the coming decade with BA/ LN well positioned to benefit.

-

RELX PLC (REL LN) – Concerns over AI-driven disruption continued to hurt sentiment on the information services sector, which weighed on shares of REL LN in Q4. Despite reporting strong performance, REL LN declined 14% in the quarter and was a top detractor. We believe the disruption narrative underestimates REL LN’s distinct and proprietary data, which are generated through a contributory consortium model. Moreover, we believe the market is overlooking REL LN’s niche dominance in attractive, growing verticals, including publishing and exhibitions.

Sector Influence

We are bottom-up stock pickers, but sector exposures influenced relative performance as follows:

-

What Helped: Overweight Materials (a better performing sector) & underweight Real Estate (a weaker performing sector)

-

What Hurt: Overweight Communication Services (a weaker performing sector) & underweight Financials (a better performing sector)

Trades During the Quarter

-

Exited: NXP Semiconductors NV (NXPI) – Sale reflects higher conviction in other opportunities. We elected to use NXPI as a source of funds.

-

Initiated: Aena SME SA (AENA SM) – AENA SM is an airport infrastructure company operating the Spanish airports, its primary asset. AENA SM operates under a “dual till” regulatory model where the landing fees are regulated while all other operations, like concessions, retail, parking, VIP lounges, etc., are unregulated. Roughly 70% of AENA SM’s value is driven by the high-return, unregulated business which we believe is underappreciated by the market. As AENA SM prepares to enter the next regulatory period, investor sentiment has soured on potential capex increases. We took advantage of this dislocation to purchase the shares in the quality operator. We believe the capex will provide attractive returns in the business, and an underleveraged balance sheet provides confidence in the continuation of attractive shareholder distributions.

-

Increased: Magnum Ice Cream Co (MICC LN) – MICC LN was spun-off from Unilever during the quarter. MICC LN is the largest ice cream company globally trading at an attractive valuation with opportunity for margin improvement under focused leadership. After receiving the spin off shares, we added to our position.

Looking Ahead

As we move into 2026, the economic and policy backdrop remains characterized by a mix of support and uncertainty. From an economic perspective, we expect modest economic growth across the developed international markets with balanced risks from sticky inflation, unemployment and trade flare-ups. In terms of policy rates, we continue to expect an accommodative posture from Europe and UK central banks while Japan looks to continue normalizing rates into 2026 – similar trend from 2025. We expect continued focus on domestic policies around defense spending and infrastructure, which should be supportive to domestic growth.

In terms of equities, we maintain a favorable view of the international landscape. In 2025, international markets delivered stellar returns, supported by earnings growth, multiple expansion and U.S. Dollar weakness. Even after such a strong year, international markets are still valued at a sizeable discount to the U.S. We believe this will continue to be supportive of fund flows into international markets providing a positive outlook into 2026. Beneath the surface, returns for the year in the MSCI EAFE were driven by the low-quality businesses; meanwhile, Quality factors were significantly out of favor. We don’t believe this trend can last forever. We’re well positioned for such a reversal, with a portfolio of attractively valued quality businesses that can outperform the market cycle while providing solid downside protection.

Annualized Returns

As of 12/31/2025

Inception date: 9/30/2023. Performance is preliminary. Subject to change. Past performance should not be taken as a guarantee of future results. Net of fee returns are calculated net of an annual model management fee of 0.75%. Please see the disclosure notes found on the bottom of the page.