Insights from the CIO

Founder, Chairman, and Chief Investment Officer

Investment Takeaways

- Productive capital allocation can be critically important to the sustainability of a business and returns for long-term shareholders.

- Buybacks offer many benefits to company management and investors, and they can be an efficient means of returning capital to shareholders.

- Not all buybacks are created equal! Some approaches can lead to poor outcomes for long-term shareholders.

- Share repurchase efficiency can be assessed in a number of ways, but we believe the Effective Ratio & Shareholder Yield are two of the most important.

- We believe companies with productive capital allocation plans that responsibly return capital to shareholders will be at an advantage in the years ahead.

Perspectives on the Market

Over the past year, we have stressed the importance of shareholder yield and risk management as we exit the era of ultra accommodative monetary policy. In our Decade of the Dividend piece last fall, we explained why we believe dividends will enjoy a resurgence and become an increasingly important component of investors’ total returns this decade. Now, we’d like to focus on the other major component of shareholder yield—buybacks.

For the past 10+ years, a seemingly infinite tide of central bank liquidity helped lift all boats. The era of easy money masked some profligate uses of shareholder capital. Further, it was also a period in which the quality of senior management teams and boards of public companies was of little consequence; a time when managers often received priority over shareholders.

Over the past year, however, the cost of capital has sharply risen, and therefore the hurdle rate for capital investments has spiked too. In our view, the bar has been raised. The ‘growth at all costs’ playbook has been upended, and the new economic reality demands long-term sustainable growth and profitability. Furthermore, we believe the quality of senior management and boards will matter once again. In our view, effective capital allocation and share repurchase efficiency will have significant investment implications in the years ahead.

4 Insights Into the Importance of Capital Allocation & Net Buybacks

1. Productive capital allocation can be critically important to the sustainability of a business and returns for long-term shareholders.

Capital allocation is one of the most important tasks of company management. It’s the decision about what the company will do with the money it earned. In general, a company has four capital allocation options:

- Business reinvestment (e.g. CapEx and R&D)

- Return capital to shareholders (e.g. Dividends and Buybacks)

- Pay down debt

- Mergers & acquisitions (M&A)

When asked about our preference, we typically say that it depends on the investment opportunities for each company as well as the valuation of its stock. A company’s hurdle rate or weighted average cost of capital (WACC) is an important factor in this decision. It represents the minimum required return for a particular project to be feasible.

If a company generates high returns on invested capital (ROIC) that exceed its cost of capital and it can continue to invest at that rate, then business reinvestment is often the best option. As companies mature and there may be fewer attractive growth opportunities, dividends or share repurchase can be better options. Debt pay down or building up cash reserves can be especially beneficial going into an economic slowdown or a recession. Finally, M&A transactions are also an option. That said, academic research shows that most M&A deals are not accretive, but management teams are often seduced by the hope of new business or growth opportunities. M&A is our least preferred option for allocating capital.

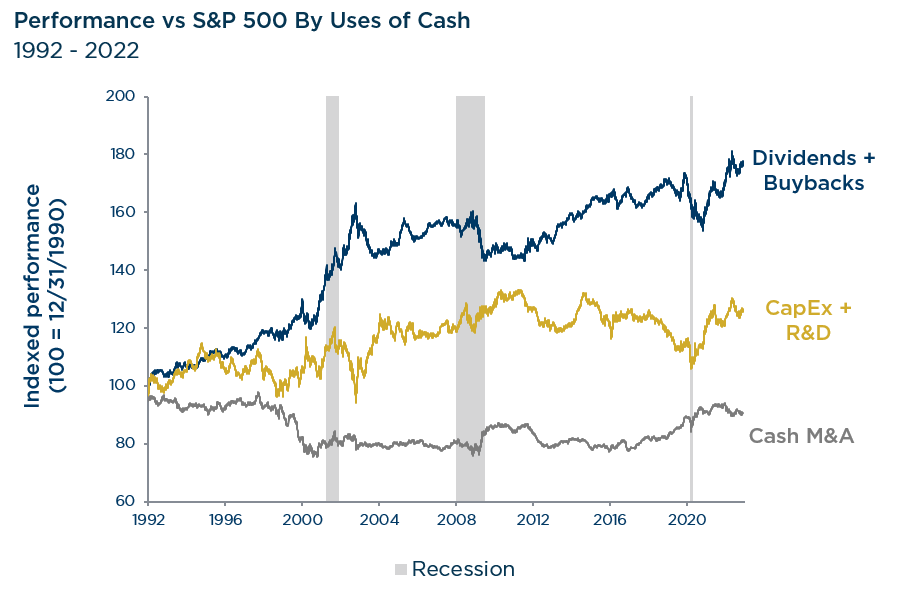

Historically, companies spending the most on dividends and buybacks have a long-term track record of outperformance versus alternative uses of cash. We also believe this reflects the gravity of capital allocation decisions and their real-world investment implications.

Source: Goldman Sachs. Data from 12/31/1990-12/1/2022. Past performance should not be taken as a guarantee of future results.

2. Buybacks offer many benefits to company management and investors, and they can be an efficient means of returning capital to shareholders.

Over time, buybacks have become management teams’ preferred method of returning capital to shareholders versus dividends. Today, more than 50% of S&P 500 companies engage in buybacks, and, according to Strategas, annual spending on buybacks has more than tripled since 2010, to over $900B per year.

The increased use of buybacks over dividends is mainly driven by some key advantages, including tax benefits and financial flexibility. The tax rate on capital gains is typically more favorable than that on dividends. In terms of flexibility, dividends are perceived by investors as long-term commitments; whereas, buybacks are not held to the same ‘mandatory’ standard. Investors usually have more adverse reactions to dividend cuts than to postponing or even abandoning a buyback program.

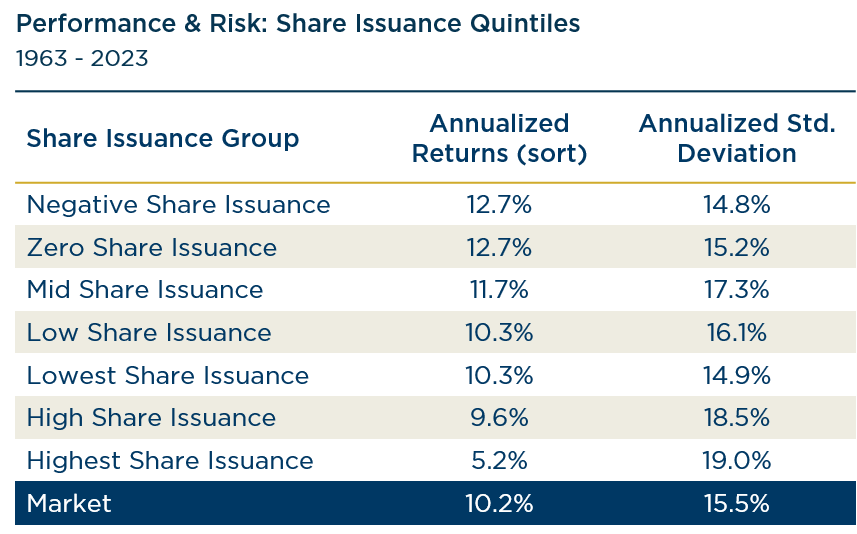

For shareholders, the primary benefit of buybacks is that it increases owners’ claim on earnings. Historically, companies that reduce shares outstanding typically have higher returns with less risk than the broader market and companies with high degrees of share issuance—which dilutes existing shareholders.

Source: WisdomTree, Ken French Data Library, 7/31/1963 – 2/28/2023. Past performance should not be taken as a guarantee of future results.

3. Not all buybacks are created equal! Some approaches can lead to poor outcomes for long-term shareholders.

While share repurchases can be an effective use of company cash, buybacks can also be abused or used in ways that do not benefit long-term shareholders. In theory, companies should only engage in buybacks when they don’t have anything better to do with cash on hand or when its share price trades at a compelling discount to fair value. Unfortunately, there are many examples of company leadership breaking those rules over time. Greed, self-dealing and short-termism by management and boards can have consequences for the long-term success of the business, its workers, and shareholders. In general, there are three categories of net buybacks that can lead to poor outcomes for long-term shareholders:

- Buybacks at excessive valuations – Not only does this divert capital from productive investments that could generate long-term value, companies also run the risk of seeing their share price meaningfully decline.

- Buybacks at the expense of financial health – If a company burns through its rainy day cash reserves or takes on unhealthy levels of debt to buyback shares, it can lead to a balance sheet that is financially weakened and vulnerable to economic shocks.

- Stock option grants in excess of shares repurchased – Some companies engage in large stock-based compensation (SBC) plans, which raises the number of shares outstanding and dilutes existing shareholders.

In theory, stock-based compensation (SBC) aligns employee and owner incentives, yet SBC effectively dilutes existing owners’ claim on earnings. This circular process of issuing new shares to employees and then buying those shares back with company money (read: shareholder money) is called ‘sterilization.’ Over the past 10+ years, this practice became increasingly commonplace, with little consequence. The primary beneficiaries of these wealth transfers were managers—not the entrepreneurs, risk-takers, or true innovators. Going forward, we anticipate greater scrutiny over such actions and more discipline with shareholder capital.

4. Share repurchase efficiency can be assessed in a number of ways, but we believe the Effective Ratio & Shareholder Yield are two of the most important.

Like everything in investing, there are lots of nuances, and these metrics should be considered in conjunction with other fundamental and financial health factors.

For example, if a company reduced shares outstanding by 500K and repurchased 1,000K shares, the Effective Ratio would be 0.5. In other words, for every $1 spent on buybacks, investors got a $0.50 equivalent reduction in the shares outstanding. In general, a ratio near 0.75 or higher is preferred. Anything below 0.5, you start to see meaningful dilution.

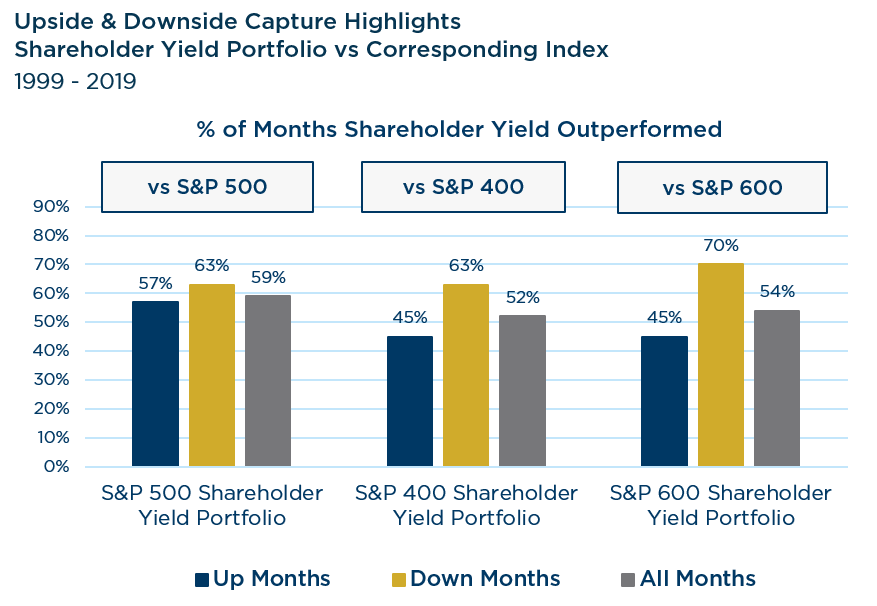

Shareholder yield is effectively the sum of the dividend yield, net debt paydown yield, and net buyback yield. A careful review of the component metrics can help investors avoid companies that offer large amounts of SBC and/or take on a lot of debt, particularly to buy back shares. A high total shareholder yield indicates that a company is returning strong amounts of capital to owners compared to its market price. A recent study by S&P Global found that companies across the market cap spectrum with higher shareholder yields delivered competitive upside capture with very strong downside protection over their benchmark indices, helping lead to stronger total returns with less risk over the long term.

Source: S&P Dow Jones Indices LLC. Data from 12/31/1999-12/31/2019. Past performance should not be taken as a guarantee of future results.

In Summary

As the tide of central bank liquidity goes out, we believe quality businesses will separate from the pack and senior management quality may matter again. Relative to the prior decade, we anticipate higher interest rates, higher and more variable inflation, and more modest equity returns with greater volatility. Multiple expansion may be constrained, and companies will likely need to earn their returns. A higher hurdle rate for business reinvestment should compel greater capital allocation discipline.

We believe a focus on shareholder yield can help dampen volatility while enhancing overall total returns in the years ahead. Historically, companies spending the most on dividends and buybacks have a long-term track record of outperformance versus alternative uses of cash. Moreover, companies with a track record of share reduction have delivered better performance with less risk than companies with high share issuance. Finally, the favorable upside & downside capture provided by companies with attractive shareholder yields should help lead to attractive risk-adjusted performance versus the broader market.

We believe companies with productive capital allocation plans that responsibly return capital to shareholders will have an advantage in the years ahead. Importantly, not all buybacks are created equal. In our view, investors should focus on companies with a track record of share repurchase efficiency and prioritizing long-term shareholder value.

View Our Strategies

See the latest performance data