To clients and friends of The London Company

Feeling the Squeeze

Executive Summary

- A surge in treasury yields pushed equities of all sizes and styles into negative territory for Q3 and wiped out YTD gains in some of the most vulnerable areas of the market (i.e. smaller caps and less profitable companies).

- Fed rate hikes & tighter lending standards have squeezed Main Street, but Wall Street has faced limited pressure—for now.

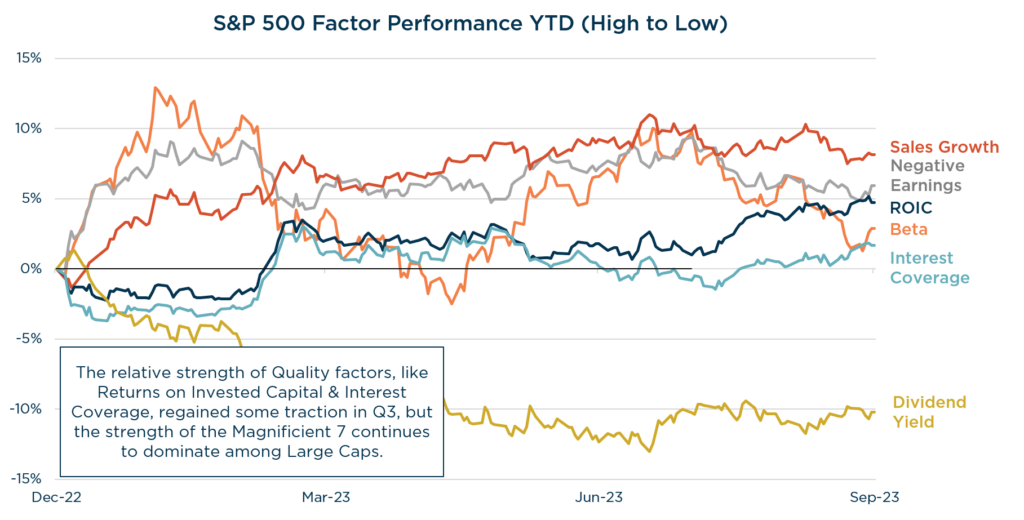

- Quality factors, like high returns on capital & healthy leverage ratios, have been positive this year across the broad market, but their impact on relative results has been diminished by the strength and skew of the Magnificent 7 at the Large Cap level.

- From our vantage point, we believe uncertainty will persist into the foreseeable future as recession risks remain elevated.

- We believe rising debt servicing costs will become a growing part of the macro conversation from here. We foresee a multi-year backdrop that favors companies with strong balance sheets and the ability to self-fund their operations.

Like a vise, the lagged effect of the Fed’s interest rate hikes continues to steadily apply pressure to the economy and markets. Some areas are feeling the squeeze more than others, but the broader economy has been surprisingly resilient. In an ironic twist, this same economic resilience contributed to a sharp rise in yields during the quarter. This further tightened the screws on financial conditions. The surge in yields helped lead to the broad market’s first pullback since February.

The third quarter ended on a down note with the S&P 500 posting a -3.3% decline. Until recently, the perceived benefit of lower inflation outweighed all other macro risks. Inflation progress and healthy labor markets fanned investor optimism and bolstered consensus expectations for a soft landing. As the quarter progressed, however, there was growing acceptance of the Fed’s “higher for longer” mantra. A resilient economy, a jump in energy prices, and U.S. deficit concerns all contributed to a surge in treasury yields in Q3. The downturn in the market pushed equities of all sizes and styles into negative territory for Q3 and wiped out YTD gains in some of the most vulnerable areas of the market (i.e. smaller caps and less profitable companies). The higher rate backdrop blunted some of the momentum of the richly valued Magnificent 7 (Apple, Microsoft, Amazon, NVIDIA, Alphabet, Tesla & Meta Platforms), but the group’s leadership remained firmly intact. Energy was the only positive sector during Q3, benefiting from the best quarterly rise in crude oil prices since the invasion of Ukraine in Q1’22. Turning to market factors, Quality performed well amidst the growing uncertainty. Companies with high returns on invested capital and balance sheet strength (i.e. higher interest coverage or low leverage) performed well, though the positive impact was most pronounced down the market cap spectrum. Growth lost some of its momentum, while Volatility factors were the biggest detractors. Meanwhile, Yield continues to significantly lag in this higher rate environment.

Source: Piper Sandler. Period 12/31/22-9/30/23. Measures the forward price return of the companies in the S&P 500 high & low quintile baskets of stocks by factor. Factors are sector neutral. Quintile baskets are rebalanced monthly at the beginning of each month.

So, why haven’t we seen the “most anticipated recession of all time” yet? The answer could be partially due to the fact that many publicly traded companies wisely refinanced their debt between 2020-2022, locking in low, fixed rates and extending their maturities. So, even as the Fed aggressively raised rates over the past 18 months, corporate interest payments relative to revenues actually touched their lowest levels in over 50 years. If you’re a small business or don’t have access to the capital markets, then you’ve likely had a different experience. Corporate bankruptcies, which include small businesses, have surged in 2023, piling up at the fastest pace since 2010. Historically, credit spreads on corporate bonds lead bankruptcies, but we’re seeing the inverse this cycle. Combined with tighter bank lending standards, the Fed’s rate hikes have squeezed Main Street, but the same effect has not caught up to Wall Street—yet. Tight credit spreads are an artifact of the now-expiring stimulus effects. With the era of cheap money over, the interest burden will be going up, which will likely favor higher quality businesses with healthy balance sheets.

There is still pain from higher rates, of course, and that steady compression has created a split between the haves and have-nots in the market. The disparity between winners and losers is most evident when looking at size. According to research by Société Générale, the effective interest rate being paid by the largest 10% of companies in the S&P 1500 index is barely up from its lows and still below its pre-pandemic peak. Meanwhile, the rate paid by the smallest half of companies in the index has risen to the highest level in more than a decade. The disparity between the winners and losers from rate increases provides another reason for why Small Caps have lagged Large Caps by the widest margin in nearly 22 years! Apart from size, higher quality borrowers have been the other big winners as yields have risen. That said, the relative advantage of higher quality has been highest down the market cap spectrum where we see weaker profitability, higher borrowing costs, shorter loan maturities, and more use of floating rate debt. At the Large Cap level, the effect of quality is distorted by the strength and skew of the Magnificent 7. These seven companies, the largest by market capitalization, represent roughly 28% of the S&P 500, but they were responsible for approximately 84% of the index’s 13.1% YTD return. So, even though Quality factors have been positive this year across the broad market, their impact on relative results has been diminished by the strength and skew of the Magnificent 7 at the Large Cap level.

Strategy Recap

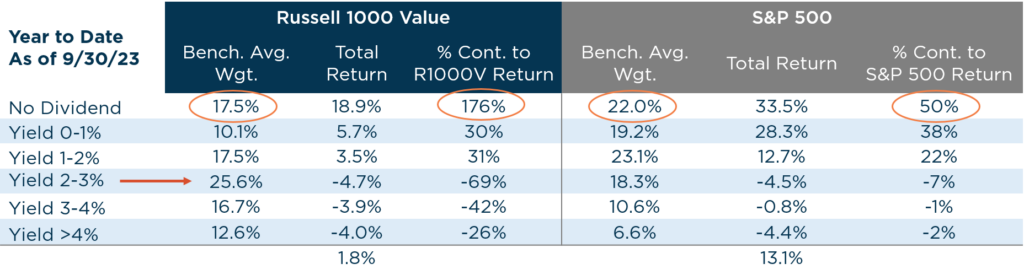

Turning to our performance, The London Company portfolios produced mixed results in Q3 amidst the various macro crosscurrents. Each of our portfolios and their respective benchmarks finished in negative territory for the quarter. Our Mid Cap and Small Cap portfolios protected well on the downside versus their respective benchmarks and exceeded our long-term 75% downside capture target. Unfortunately, our Large Cap, Income Equity, and SMID portfolios lagged their benchmarks for the period. When looking at YTD results, the relative advantage of our Quality-orientation has been strongest down the market cap spectrum. Our Mid Cap, SMID and Small Cap portfolios have handily outperformed their benchmarks and exceeded our longer-term 85-90% upside capture target. Meanwhile, our Large Cap and Income Equity portfolios have trailed their benchmarks thus far. The dominance of the Magnificent 7 and resulting opportunity cost from having limited exposure to this group has been the biggest headwind to relative performance this year. An additional headwind facing our Income Equity portfolio has been the continued weakness of dividend yield. Higher rates are a headwind for yield-oriented equities, but they also reduce their appeal relative to bonds and money markets paying >5%. As the table below shows, non-dividend payers have dramatically outpaced dividend-paying stocks in both the S&P 500 and Russell 1000 Value. Moreover, roughly 50% of Income Equity’s holdings have a yield between 2-3%, which has been the weakest segment of the yield buckets for both indexes.

Source: FactSet.

Despite having a singular investment process that prioritizes Quality, it’s not uncommon for our relative performance results to vary across strategies over the short term. While our Large Cap and Income Equity portfolios have fallen short of expectations so far this year, we should note that things can change quickly with a relatively concentrated portfolio. Additionally, weakness typically works its way up from the bottom. So, while the full benefits of Quality and Dividend investing have recently been delayed at the Large Cap level, we don’t believe they will be denied longer-term.

Weakness typically works its way up from the bottom. So, while the full benefits of Quality & Dividend investing have recently been delayed at the Large Cap level, we don’t believe that they will be denied in the long-term.

Looking Ahead

As we head into the final months of 2023, the macro outlook remains increasingly uncertain. Taking a glass-half-full perspective, notable tailwinds include the tight labor market, rising wage gains, resilient corporate earnings, and continued progress on inflation. Higher rates are eating into household budgets, but the share of household debt that adjusts with market rates still hovers near 40-year lows. These positive dynamics are counterbalanced with growing concerns over weakness in Europe & China, the lagged effect of Fed rate hikes, tight lending standards, plus a yield curve that remains inverted. Elevated energy prices, resumption of student loan payments, dwindling of pandemic savings, and rising rates of delinquency are additional headwinds for U.S. consumers. We still have a top-heavy market with narrow leadership in the richly valued Magnificent 7. Moreover, dysfunction in D.C. isn’t helping the situation. From our vantage point, we believe uncertainty will persist into the foreseeable future as recession risks remain elevated.

Regardless of whether we get a Soft or Hard Landing, we believe rising debt servicing costs will become a growing part of the macro conversation from here. Years of cheap money enabled a lot of cans to be kicked down the road, but now an immense corporate debt maturity wall is beginning to creep into view. Longer term, we remain optimistic about the prospects for the U.S. economy and equity markets, but elevated debt loads coupled with higher rates present major refinancing risk over the next several years. Servicing that debt may cut into corporate profits, capital spending, hiring, economic growth and investor returns. As America grapples with its debt burdens, we foresee a multi-year backdrop that favors companies with strong balance sheets and the ability to self-fund their operations. We believe higher-quality companies, of all sizes, again will assert their structural advantage. Even though the competition for capital is fierce today, we also firmly believe dividends will enjoy a resurgence in the years ahead. The potential for lower returns could mean dividends’ contribution to total return could be increasingly important and revert toward historical norms.

We approach the path ahead with humility, simplicity, and discipline. We know from history that a reliance on Quality and Dividends has proven to be a strategy that can lose battles along the way but tends to win the war over time. We take comfort in the durable profitability, strong free cash flow and balance sheet flexibility of our companies. These attributes give our portfolios precious breathing room as the squeeze from tighter financial conditions continues.

As always, we appreciate and highly value the trust you have placed in us.

Source: Piper Sandler. Period 1/2/1985-9/30/2023. Measures the forward price return of the companies in the S&P 500 high & low quintile baskets of stocks by factor. Factors are sector neutral. Quintile baskets are rebalanced monthly at the beginning of each month.

View Our Strategies

For more information