To clients and friends of The London Company

Herd Mentality

Executive Summary

- 2023 ended with an “everything rally” sparked by an easing of financial conditions & the Fed’s indication of a policy pivot.

- There was a notable broadening of market strength in Q4, but the S&P 500 remains historically top-heavy and the Magnificent 7 stocks drove the majority of the S&P 500’s return for the year.

- Following prior episodes of peak concentration, there has historically been a prolonged digestion period in the market, which typically favors lower market capitalizations and active management. We believe we’re approaching a similar inflection point.

- For our portfolios, the relative advantage of our Quality-orientation was strongest down the market cap spectrum. The dominance of Growth & Volatility factors combined with the weakness of Yield were headwinds for our large cap portfolios.

- After such a strong 2023, we believe investors should temper expectations for 2024. Even with greater clarity over the Fed’s path from here, the list of items creating uncertainty remains long and the risks of recession remain elevated.

“Mimicking the herd invites regression to the mean.” -Charlie Munger

Given the dramatic swings and stampeding nature of markets in 2023, we’re reminded of one of Charlie Munger’s many witty zingers of wisdom. The world lost an investment legend this quarter with his passing at the age of 99. Charlie was perhaps best known as Warren Buffett’s #2 at Berkshire Hathaway, but to many he was regarded as one of the finest investors of his generation. Early on, he instructed Buffett on the advantages of buying wonderful businesses at fair prices versus Buffett’s legacy approach of buying fair businesses at wonderful prices, aka cigar butts. We count ourselves among the Munger disciples, and that quality at a reasonable price approach Charlie advocated is the backbone of our investment process here at The London Company. So, we call on Charlie once again to help provide perspective on Q4’s “everything rally” and 2023’s market strength that few saw coming.

The final quarter of 2023 emerged as a period of robust growth, characterized by double-digit gains across all major equity indices and a notable broadening of market strength. That said, Q4 got off to a rocky start. Before peaking in October, a sharp rise in treasury yields pushed the S&P 500 into correction, dropping 10% from its July peak. Stocks found a second wind, however, as economic data affirmed hopes for a soft landing and financial conditions dramatically eased. Euphoria set in when the Fed indicated it would likely shift to trimming interest rates, rather than raising them. Combined with heavy corporate buyback activity and seasonality, there was a positive feedback loop for risk assets in Q4. Stocks, bonds, gold, and even crypto currencies all surged simultaneously. The S&P 500 was up 11.7% in Q4 and finished just 0.6% below its January 2022 record close. Small and Mid-Cap stocks edged out the cap-weighted S&P 500 in Q4, breaking away from the dominance of the mega-cap Magnificent 7 (Apple, Microsoft, Amazon, NVIDIA, Alphabet, Tesla &, Meta Platforms). Some of the biggest beneficiaries of the drop in yields were the beaten-down victims of the rise in yields: regional banks, property stocks, cyclical sectors, and low quality, highly levered companies. Looking at market factors, Volatility and Growth were positive in Q4 while Value and Yield factors were mixed. Quality and Momentum factors were the biggest detractors during the final quarter.

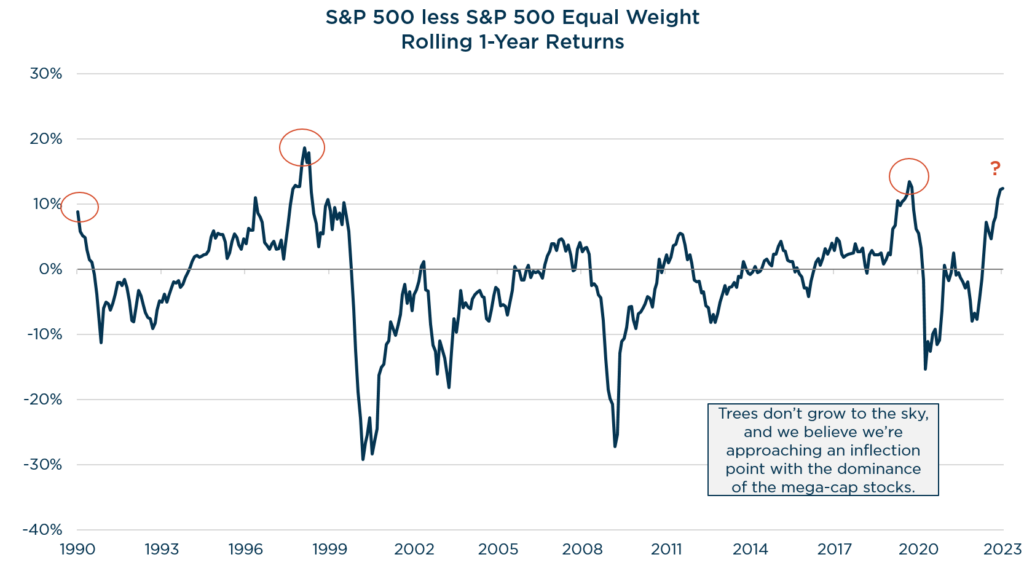

The recent broadening out of the market has been a welcome reprieve, yet the S&P 500 remains historically top-heavy and the Magnificent 7 are still the crowd favorite. By year-end, the ten largest stocks accounted for 32% of the S&P 500 by weight and drove nearly 68% of its 2023 return. While this is down from the over 130% earlier in the year, it was the 2nd largest percentage contribution from the Top 10 stocks on record. Moreover, the spread between the cap & equal weighted S&P 500 widened to the 2nd largest positive spread on record. In our recent Insights from the CIO piece “Mega Cap Dominance & Growing Sequence Risk,” we covered this topic and the risks this group poses to the cap-weighted large cap indices. Importantly, we do not need to experience a difficult recession or some shock to the economy for the largest companies to underperform the broader market. Sometimes, growth expectations just get too high and/or valuations become extreme. An important lesson from the Tech Bubble is that overpaying for future growth can be costly to future returns. You can be right on the business and still be wrong on the investment. Following prior episodes of peak concentration, there has historically been a digestion period in the market, which can take years to unwind. This typically favors the ‘average stock’ and active management. While the large cap core and growth indices have been the best places to be over the past decade, we believe we could experience a reversal of market leadership in the years ahead. Leadership that favors lower market capitalizations and a quality value orientation. We believe active management, with a focus on risk mitigation, is well positioned to help investors navigate these risks and increase the potential for financial success.

Source: eVestment. 12/31/1990-12/31/2023.

An important lesson from the Tech Bubble is that overpaying for future growth can be costly to future returns. You can be right on the business and still be wrong on the investment.

Strategy Recap

The London Company portfolios saw mixed results in Q4 amidst the “everything rally” stampede. All of our portfolios experienced solid absolute returns, but only Mid Cap and SMID outperformed their benchmarks—exceeding expectations. Small Cap finished in line with our 85-90% upside capture target, but Large Cap and Income Equity both fell short of expectations. Underexposure to regional banks and low quality, highly levered companies was a headwind for Small Cap during the risk-on thrust of Q4. Meanwhile, within the large cap space, we continued to face headwinds from exposure to lower beta and higher quality holdings as well as underexposure to Growth & Volatility factors.

For the full year, the relative advantage of our Quality-orientation was most apparent down the market cap spectrum. Our Mid Cap, SMID, and Small Cap portfolios handily outperformed their benchmarks and far exceeded our upside participation expectations. We typically would not expect such strong relative results in a robust, double-digit return environment, but several factors worked in our favor. Quality attributes, including high net interest coverage and returns on capital, shone prominently, particularly as many unprofitable companies in the lower market cap spectrum struggled. Our largest positions performed well, opportunistic trades and recent initiations paid off, and we navigated the year with few major setbacks. A sector-level leadership reversal also played a role, with our limited exposure to Energy and Utilities transforming from a drag in 2022 to a tailwind in 2023. Unfortunately, our Large Cap and Income Equity portfolios did not mirror the same relative success. Both fell short of benchmarks, with Growth & Volatility factors dominating the large-cap indices in 2023. The concentrated strength and skew from the Magnificent 7 diminished the relative impact of Quality factors. Although our Energy underweight was beneficial, the rise of GLP-1 weight loss drugs adversely impacted consumer staples stocks, where we are overweight. While Q4’s drop in yields eased pressure on dividend payers, the yield orientation of Income Equity posed a significant headwind to relative performance in 2023. Notably, almost 40% of the S&P 500’s return and about 50% of the Russell 1000 Value’s return came from stocks that do not pay a dividend!

Specific to Income Equity, we’d like to offer additional context regarding its recent relative weakness. Over the 23 years since its inception, the portfolio has outperformed the Russell 1000 Value and S&P 500, while showcasing lower risk characteristics. Recent challenges emerged against these benchmarks, however, due to our yield-oriented approach, an underweight position in Energy, and a focus on valuation sensitivity. Moreover, with limited signs of credit stress, our balance sheet strength value proposition has been more of a luxury than a necessity.

- Versus the S&P 500, 2023 was the most challenging year in the portfolio’s history, as nearly every market factor worked against us. Concentrated leadership around a handful of mega-cap growth companies has been a multi-year trend (remember ‘FANG’ preceded the Magnificent 7) that has helped the large cap Core & Growth indices dominate most other segments of the market. So, despite delivering strong downside protection during 2022’s bear market, our 3, 5, and 10-year relative results have trailed.

- Versus the Russell 1000 Value, it’s a slightly different story. After five consecutive years of outperformance (2017-2021), Income Equity lagged in each of the last two. In 2023, our yield orientation and the opportunity cost of not owning certain mega-cap companies impacted relative results. Additionally, being underweight Energy in 2022 posed a significant headwind. The Energy sector’s remarkable performance in 2021 (+53%) and 2022 (+65%), contributed to an annualized three-year return of 36%—one its best three year results in 35 years!

When nearly every market factor works against you in a year, it clearly means you’re fishing in the wrong pond. Short-term deviations from our benchmarks can be expected, but we’ll never bend our portfolios to align with the latest trend. As leadership shifts, so can relative results, and with a concentrated portfolio adjustments can occur swiftly.

Given the recent divergence in the relative performance of our portfolios, we’re reminded of another one of Charlie Munger’s insightful aphorisms: “The big money is not in the buying and the selling but in the waiting.” At The London Company, part of our distinctiveness lies in our long-term focus and cohesive one team, one process approach.

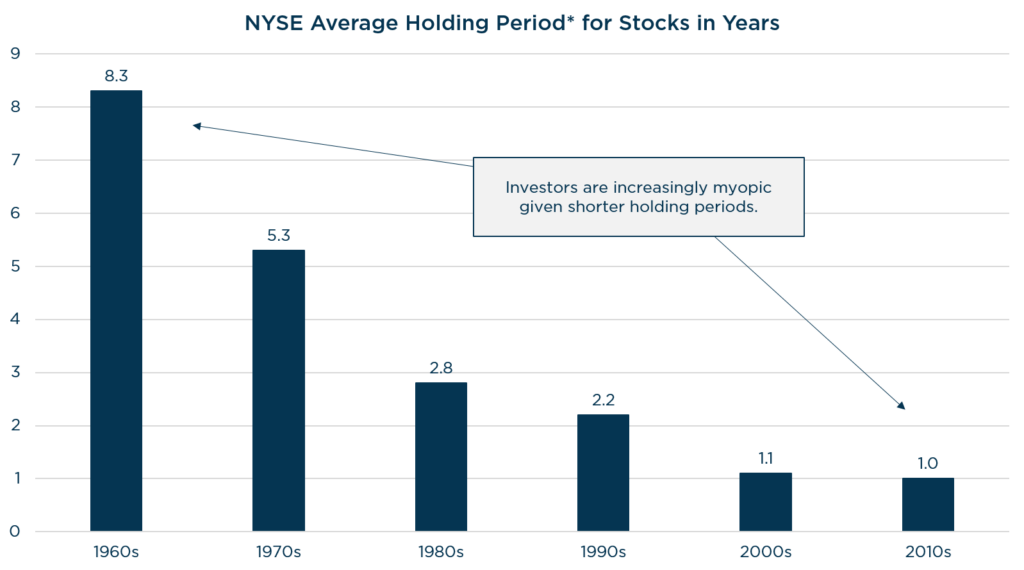

Source: Strategas. Holding Period Proxy = 1/turnover.

Source: FactSet. Data as of 12/31/23.

Many claim to be long-term oriented, but we actually walk the talk. Our commitment is evident in holdings spanning over a decade, with many examples of holdings that transitioned from our Small Cap to Large Cap or Income Equity portfolios. We view this long-term orientation as an advantage, since shorter holding periods magnify the importance of being right on the direction and timing of the business cycle. Our singular investment process, executed by a unified team, also sets us apart. Although our Small and SMID portfolios currently show strong results, past challenges arose from a surge in unprofitable companies and the dominance of expensive growth-oriented firms in the Russell 2000 from 2015 to 2020—when the index concentration of unprofitable companies reached an all-time high of 49%. While a similar concentration dynamic exists in large-cap indices today, the quality and valuations of the businesses are higher. Our Small and SMID portfolios benefited from a favorable turn in small-cap indices, and we anticipate a parallel advantage for our Income Equity and Large Cap portfolios when this large-cap leadership cycle shifts. Putting it all together, we’ve been here before. A holding period of over five years inevitably brings short-term dissonance with market trends. The enduring success of Warren Buffett and Charlie Munger underscores that good investing involves taking a view, usually not the trendiest one, and patiently sticking with it because markets are impossible to outguess in the short run.

As always, we appreciate and highly value the trust you have placed in us.

“The big money is not in the buying and the selling but in the waiting.” –Charlie Munger

View Our Strategies

For more information